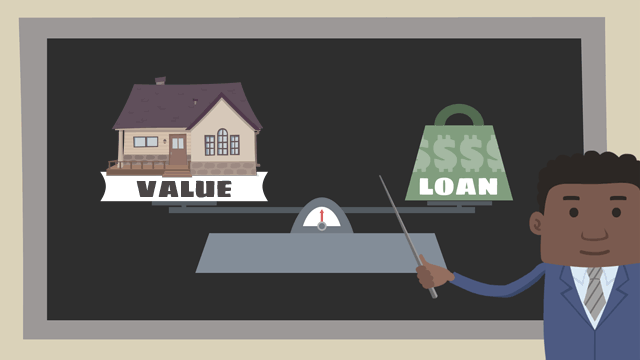

Loan-to-Value Ratio

Related Terms: LTV, Maximum Loan-to-Value Ratio

The loan-to-value ratio is a metric lenders use to determine risk of loaning money to you as a borrower. The ratio represents the loan amount as a percentage of the property value; it is calculated by dividing the amount of money requested in the loan by the property value of the home.

The property value used to calculate the ratio come from the home appraisal. Whatever number comes in the appraisal report is used by the lenders. The ratio is then sent along with the loan application for underwriting purposes after which you’ll be quoted an interest rate for the loan. In addition to determining that you qualify for the loan, lenders use this ratio to calculate the costs and fees you will incur for borrowing the money.

If your LTV ratio is low, you may qualify for lower interest rates. A lower loan-to-value ratio means there is more equity on the home, and you are considered less risky to default on the loan. It also gives the lender peace of mind because if you were to default, they could sell the property in foreclosure and make up the loss.

LTV ratios are also used to evaluate your mortgage insurance payments. If you make a 20 percent down payment on a conventional mortgage loan, the lenders may waive the private mortgage insurance payments. For FHA loans, borrowers are required to pay the minimum 3.5 percent down payment in order for their mortgage to be insured.

If your LTV ratio is low, you may qualify for lower interest rates. A lower loan-to-value ratio means there is more equity on the home, and you are considered less risky to default on the loan. It also gives the lender peace of mind because if you were to default, they could sell the property in foreclosure and make up the loss.

LTV ratios are also used to evaluate your mortgage insurance payments. If you make a 20 percent down payment on a conventional mortgage loan, the lenders may waive the private mortgage insurance payments. For FHA loans, borrowers are required to pay the minimum 3.5 percent down payment in order for their mortgage to be insured.

Do you know what's on your credit report?

Learn what your score means.