Credit Score

Related Terms: FICO score, credit report

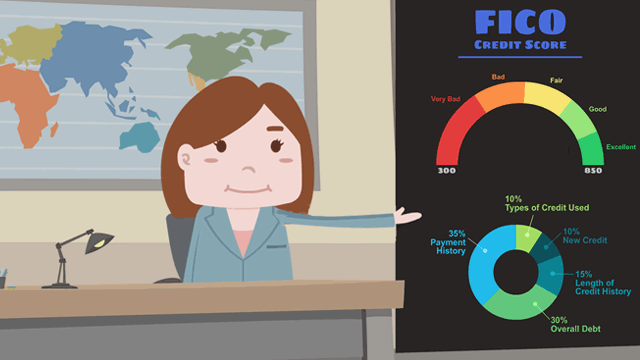

Your credit score is a number determined by applying data from your credit reports to a mathematical formula. This three-digit number helps lenders gauge how likely you are to make payments on a home loan.

There are a number of components that go into the determining credit scores. While the formula used is confidential, we know that it is partly based on a person’s overall debt, history of making payments on time, the length of their credit history, the number of times their credit has been pulled, and the types of credit used.

Credit scores can range from “Poor” to “Exceptional,” and they play an important role when lenders evaluate your financial health. The higher your score, the better your chances are of qualifying for a mortgage or getting a home loan at a lower interest rate. For instance, FHA lenders require that borrowers have a minimum score of 580 to qualify for a loan with a 3.5 percent down payment.

If you have some concerns about your credit score, here are a few steps you can take:

Credit scores can range from “Poor” to “Exceptional,” and they play an important role when lenders evaluate your financial health. The higher your score, the better your chances are of qualifying for a mortgage or getting a home loan at a lower interest rate. For instance, FHA lenders require that borrowers have a minimum score of 580 to qualify for a loan with a 3.5 percent down payment.

If you have some concerns about your credit score, here are a few steps you can take:

- Review your credit report. If you know what’s in it, you don’t have to waste time and energy with guesswork. Check to see if there are any errors and if so, dispute them.

- Make payments on time. Missed or late payments, even on credit cards can stay on your record for years.

- Pay bills with credit cards. Set up utility bill payments online through a credit card account in your name to help establish credit.

Do you know what's on your credit report?

Learn what your score means.