FHA Refinance

Related Terms: Mortgage Refinance, FHA Refinancing, FHA Refi, Mortgage Refi

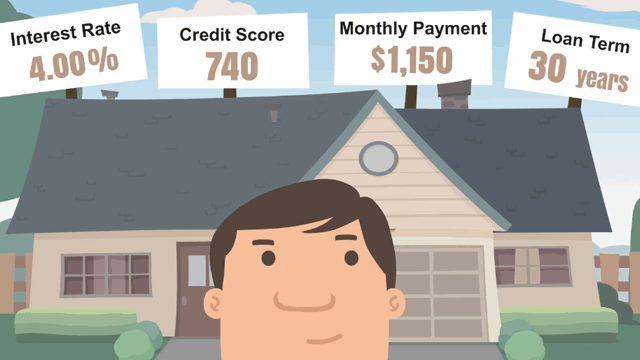

Refinancing an FHA home loan is the process of getting a new, replacement mortgage. Borrowers try refinancing their mortgages in order to get a lower interest rate, borrow cash against home equity, or to move to a different mortgage provider.

There are many advantages to refinancing your home loan…

- Many refinances lead to lower interest rates and monthly payments.

- You could avoid rising interest rates by going from an adjustable rate mortgage to a fixed rate mortgage.

- There is refinance option that allows you to consolidate debt into a single home loan, which gives you a better interest rate than credit cards or personal loans.

- You might be able to extend or shorten the term of your loan, according to your needs.

- The closing costs and refinance fees can be significant; it may cost the same or more than when you got your first mortgage.

- The interest rate may rise, going from a fixed to an adjustable rate mortgage.

- Taking out another loan on your home equity puts you in greater debt.

- By taking a cash out you would be lowering the equity, which may lead to you having to pay private mortgage insurance on your home.

Do you know what's on your credit report?

Learn what your score means.