FHA Credit and Your FHA Loan

Take the Steps to Review Your Credit

FHA loan rules apply for all borrowers when it comes to basic minimum credit standards. The FHA loan requirements that will affect your transaction include FICO score rules, down payment requirements, and the basic terms of your mortgage.

You cannot be rejected for an FHA home loan on the basis of factors that have nothing to do with your financial qualifications, employment, income, being an owner/occupier, etc. A home may not be suitable for an FHA loan, a borrower may be denied the loan because he or she doesn't intend to live in the property as the primary residence, or because of factors that affect the economic life of the property.

Credit Requirements for FHA Loans

FHA loans provide great assistance to many first-time homebuyers by offering mortgage loans with lower down payments. While this is a benefit for many people, recent changes in FHA Loan credit requirements may have put the loans just out of reach for some would-be homeowners with questionable credit history.

- The Facts About FHA Credit Requirements and FICO® Scores

- What FICO® Score Do I Need Buy A Home?

- Questions About Credit and Buying a Home

Benefits of Having Good Credit

Homebuyers looking to take advantage of great FHA loan benefits should already know they need to establish the best possible credit rating. FHA loan applicants with a better credit rating increase their options for mortgage or refinance loans.

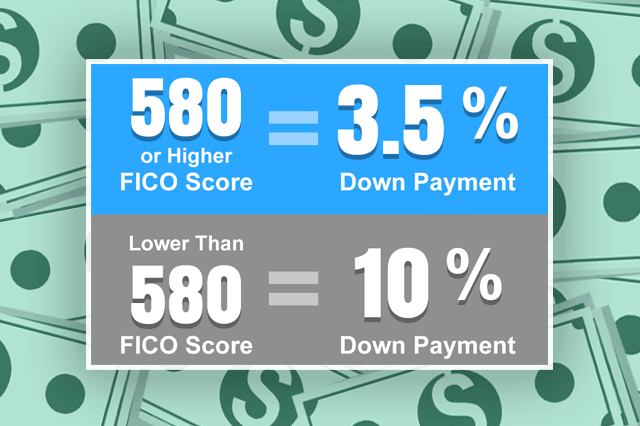

In order to qualify for the low 3.5% FHA loan down payment, applicants will need a FICO® score of at least 580. Those that don't meet that criteria will have to put a down payment of 10% on the mortgage they want.

- Qualifying for a Mortgage: 5 Things to Know

- Facts About Your Credit Scores

- How to Prepare Your Credit for an FHA Home Loan

Improving Your Credit

If your credit is less than solid, consider delaying your home purchase and work on improving their credit scores. Applicants who have a minimum credit score of less than 500 are not eligible for FHA mortgages.

While FHA loans are a great option for people buying a house, applicants can make the process even easier if they take steps toward ensuring their credit history is in tip-top shape. FHA advises prospective homebuyers to approach the loan process with their best possible credit history to eliminate any potential risk of not qualifying.

- FHA Loans, Missed Payments, and My Credit Report

- Minimum Credit Scores for FHA Loans

- Ways to Improve Your Credit Ahead of Your Home Loan

Fixing Credit Report Errors

Some borrowers who want to apply for an FHA loan find their applications held up by problems with what is on their credit report. Take proper steps to check the accuracy of your credit report with Experian®, TransUnion® and Equifax®.

Once you've gotten your report from the three bureaus, carefully examine your credit history for anything out of the ordinary, such as unauthorized loans taken out in your name, incorrect late payment records or anything that seems questionable, no matter how minor you think it is.

- Credit Monitoring, Data Security Breaches, and Your FHA Loan

- The Facts About FHA Credit Requirements and FICO Scores

- FHA Home Loan Applications and Credit Freeze Issues

Identity Theft and Fraud in the News

Now more than ever, it is crucial to pay close attention to your credit reports due to elevated security breaches, hacks, and security compromises. No major corporation is immune to these attacks-including the credit reporting agencies themselves.

We've listed a timeline of some of the most headline-grabbing hacks reported in recent years. Remember, these are only SOME of the incidents you may have heard about; each one is a good example of why it pays to continuously monitor your credit.

- FHA Home Loan Applications and Credit Freeze Issues

- Credit Monitoring, Data Security Breaches, and Your FHA Loan

- Credit Advice for Home Loan Applicants

SEE YOUR CREDIT SCORES From All 3 Bureaus

Do you know what's on your credit report?

Learn what your score means.

FHA Loan Articles and Mortgage News

April 24, 2024 - Finding or building your dream home means paying attention to many important details. Is the house you want large enough to live in for 5 to 10 years without outgrowing it? Is your house close enough to essential services like child care or school?

April 21, 2024 - Are home loans riskier in 2024 due to elevated potential for scams and fraud? Fraud prevention company Funding Shield reports high fraud vulnerability in roughly half of all portfolio loans, including residential mortgages, in the first three months of 2024.

April 19, 2024 - We write about many details of FHA home loans, and if you are on the path to homeownership for the first time, it helps to know some of the facts and fiction surrounding these home loans before you start looking for a home, a lender, or applying for pre-qualification.

April 17, 2024 - There is plenty of bad information about home loans in general and FHA loans specifically. You may encounter some of these in the wild when searching for a lender and a home to buy with an FHA mortgage.

April 16, 2024 - Home loans have many similar features. They require down payments, have appraisal standards, and may have rules on how you can use the property you buy. How do home loans compare to one another? We examine some of the major issues in this article.