Using an Escrow Account With an FHA Mortgage

The Consumer Financial Protection Bureau (CFPB) defines escrow as follows:

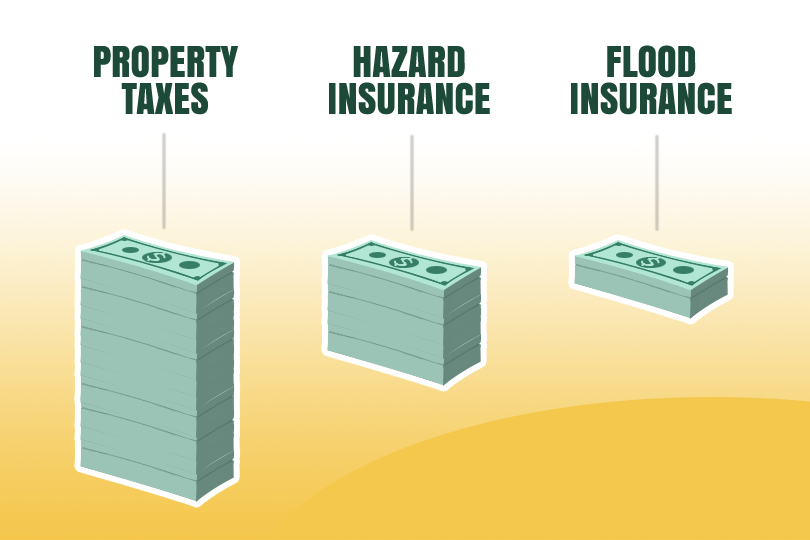

An escrow account is “any account that a servicer establishes or controls on behalf of a borrower to pay taxes, insurance premiums (including flood insurance), or other charges with respect to a federally related mortgage loan, including charges that the borrower and servicer have voluntarily agreed that the servicer should collect and pay.”

Escrow By Any Other Name

And just because the lender calls it something else doesn’t mean it’s not an escrow account. According to the CFPB official site, “escrow” is “any account” established for the purposes listed above, including impound accounts, trust accounts, and reserve accounts.

If you are getting the idea that the borrower does not have complete control over the funds in the account, you are correct. CFPB’s definition includes this caveat: “The term “escrow account” excludes any account that is under the borrower's total control.”

Escrow Terms You Should Know

There are some escrow terms newcomers will soon learn. For example, you’re entitled to an annual escrow account statement within 30 days of the end of the “escrow account computation year,” according to the CFPB official site. What’s a computation year?

A computation year is defined as the 12-month period “a servicer establishes for the escrow account beginning with the borrower's initial payment date. The term includes each 12-month period thereafter...”

When opening escrow, you may be required to maintain a “cushion” or cash reserved in the account “to cover unanticipated disbursements or disbursements” made before the borrower's payments show up in the escrow account.

Payments and Penalties

On your escrow account documentation, you may notice a disbursement date, which is the date your lender pays anyone from the escrow account.

Should there be insufficient funds in the escrow account at payment time, you may have a negative balance in escrow that needs to be corrected as soon as possible.

Payments not made on time are subject to a penalty, which may not include “any additional charge or fee imposed by the payee associated with choosing installment payments as opposed to annual payments or for choosing one installment plan over another.”

To prevent negative balances and/or penalties. Your lender may create a target balance estimate that tells you how much (minimum) to keep in escrow monthly to cover the remaining payments and any cushion requirements.

------------------------------

RELATED VIDEOS:

Annual Income Requirements for FHA Loans

Good Credit History Helps Get FHA Loans

Stay Informed About Your Mortgage Closing Costs

Do you know what's on your credit report?

Learn what your score means.