Working on Your Credit Before Applying for an FHA Mortgage

Do Some Research

If you haven’t worked on your credit for a while, it pays to research the state of the industry before you begin. Why? Because credit agencies (Equifax, Experian, TransUnion) started offering consumer credit tools in addition to credit reporting data.

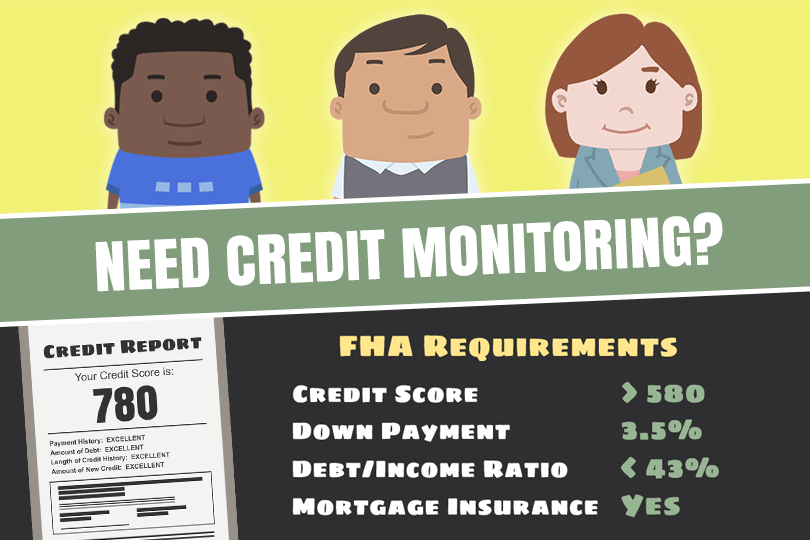

Did you know you can sign up for electronic credit alerts, credit report monitoring, and other online services through credit reporting agencies? That’s not all.

Some, like Experian, offer the ability to, in the words of Experian, “raise your credit scores instantly” by adding “positive payments” related to utility bills and other debt to your credit report file. These options can help borrowers worrying about their ability to qualify for a mortgage.

Start Early

In spite of Experian’s offer to help you raise credit scores instantly, you will still typically need a minimum of 12 months of solid credit work (on-time payments, lowering your balances and overall outgoing debt) behind you before you consider applying for a mortgage.

One important reason for that 12 month time frame? It takes time for your credit work to catch up to your credit reports. Don’t expect credit score changes overnight, this does not typically happen.

The amount your FICO scores improve by using one credit repair feature such as Experian’s offer mentioned above likely won’t be enough to get you a better mortgage loan interest rate all by itself.

Take Stock

It’s important to view your entire financial picture from student loans to revolving credit accounts you may have cosigned or are a co-borrower on.

If you’re trying to catch up on payments, ensure you don’t have an account that’s easy to overlook. Try to gather all your monthly payment information into one place for a complete review.

You want to note not only how much you owe and what the payoff dates are, but also how much of the available credit limit you are using on each account. The lower your credit utilization is for each account (30% of the limit, 50% of the limit, etc.) the better.

The closer you look at your finances, the better when it comes to getting the best rates and terms from your participating FHA lender.

------------------------------

RELATED VIDEOS:

Annual Income Requirements for FHA Loans

Good Credit History Helps Get FHA Loans

Stay Informed About Your Mortgage Closing Costs

Do you know what's on your credit report?

Learn what your score means.