FHA Home Loan Rules You Should Know

For example, do you know what to do if the appraisal comes in lower than the sale price? Or whether you can rent out an unused living unit in the home you buy with an FHA loan?

These are important things to know when you are planning and saving for your mortgage.

FHA Loan Rules for Appraisals

The appraised value of the home is an important detail. If the house is not worth as much as the seller asks for it, your lender is in a position where they cannot lend more than the actual value of the property (add-ons to the loan excluded).

For FHA mortgages, there is a rule allowing the borrower to walk away from the loan with no financial penalty in such cases.

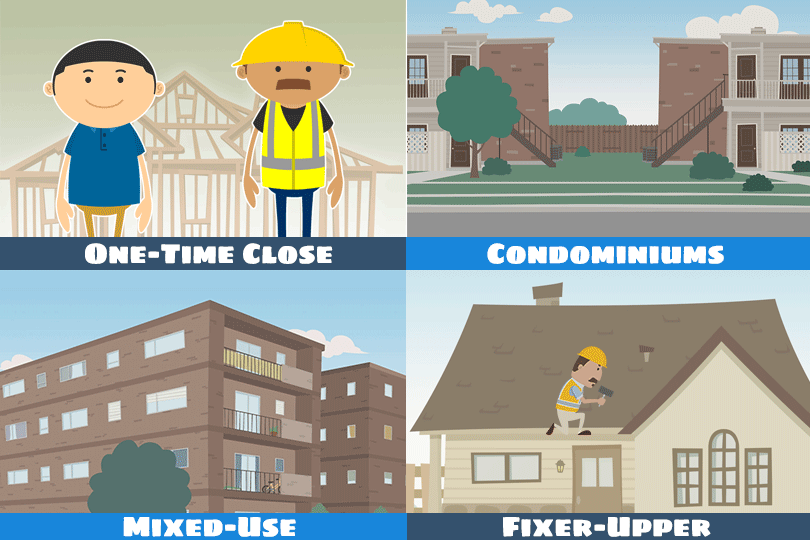

FHA Loan Rules for Multi-Unit Properties

The FHA single family home loan program allows borrowers to buy houses with as many as four living units. Unlike USDA loans, you may be allowed to generate income from the unused units, but the rule to remember here is that as the borrower you must live in at least one of those units as your primary residence.

FHA Loan Rules for Building a Home from the Ground Up

Yes, you can use an FHA mortgage to build a home instead of buying an existing property. Some borrowers want to know if they can buy land to build the home on with the same FHA loan.

The answer is yes, but borrowers cannot buy land with an FHA home loan with no plans to build. You can’t purchase “undeveloped land” with no plan to construct the home.

FHA Loan Rules for Mortgage Insurance

FHA loans require mortgage insurance for either 11 years or the full lifetime of the loan depending on the loan to value ratio and other variables. Borrowers should anticipate this expense when planning and saving for the mortgage.

FHA Loan Rules Allow Fixer-Uppers

If you find a home you want to renovate, don’t ask the lender for the standard FHA loan to buy an existing home. Instead, ask for the FHA 203(k) rehabilitation mortgage, which is made specifically to buy a house that won’t pass the appraisal and must be brought back into good repair.

------------------------------

RELATED VIDEOS:

Here's the Scoop on Conventional Loans

When Do You Need a Cosigner?

Analyzing Your Debt Ratio

Do you know what's on your credit report?

Learn what your score means.