FHA Loan Down Payment Tips

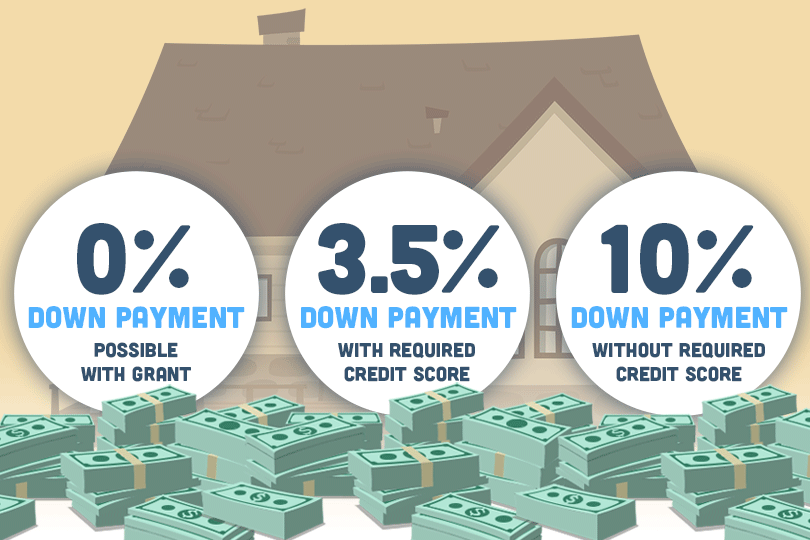

You’ll need to save up a minimum of 3.5% to put down on the loan if you credit qualify. Federal Housing Administration rules state that certain FICO scores (a minimum credit score of 580 or higher) technically qualify for this low down payment.

Those with FICO scores that are too low to qualify for the lowest down payment may still apply for an FHA mortgage, but the down payment requirement will be 10% instead of 3.5%.

Your monthly payment may be improved by putting more money down, but you will need to factor in a potentially higher interest rate in addition to the increased down payment requirement borrowers with lower FICO scores are given.

What do buyers need to know about FHA loan down payments? There are several areas to be aware of.

FHA Loan Down Payments Are Required

Unlike the need-based USDA Single Family Loan program, the FHA loan program does not have a no money down option.

Your purchase price will be offset by the down payment and as mentioned above, a lower mortgage loan amount can be an advantage if you're looking for a primary residence with a lower total loan amount.

Those applying for a One-Time Close construction loan should ask the lender about using land equity as part of the down payment, but that aside you should expect FHA loan down payment requirements to apply to you.

That is one reason why it’s a good idea to pursue down payment assistance options from your state government or a local agency.

A Clear Paper Trail Is Required

What does this mean? Simply put, if you have a large deposit in your account that doesn’t have any documentation, your lender may be unable to accept those funds as down payment money. The same is true for any down payment that is sourced in whole or in part by down payment “gifts” that are really loans that are offered with an expectation of repayment.

Your lender requires clear documentation for your down payment money not just to make sure it comes from an approved source but also to ensure that it does not come from those who are legally not permitted to provide down payment assistance.

That can be the seller--not permitted--or anyone else with a financial stake in the outcome of the transaction--also not permitted.

Down Payment Gifts Are Acceptable

FHA home loans permit down payment gifts and grants. These must clearly explain the conditions of the grant or gift, under what conditions it might be required to be paid back. That’s usually for violating the terms of the agreement or when the home is sold, paid off, or not used as the primary residence any more.

Such gifts may come from state or local housing development agencies or other local entities. The FHA does not provide down payment assistance.

Sellers Can Contribute to Closing Costs

A seller is permitted under the FHA loan program to contribute up to six percent of the sale price of the home toward closing costs. This frees up money you would otherwise have to use to close the loan and lets you put that cash toward the down payment.

------------------------------

RELATED VIDEOS:

Annual Income Requirements for FHA Loans

Good Credit History Helps Get FHA Loans

Stay Informed About Your Mortgage Closing Costs

Do you know what's on your credit report?

Learn what your score means.