Credit Requirements for FHA Loans

Good Credit History Makes it Easier to Qualify

FHA loans provide great assistance to many first-time homebuyers by offering mortgage loans with lower down payments. While this is a benefit for many people, recent changes in policy may have put the loans just out of reach for some would-be homeowners with questionable credit history.

Credit History and Score Requirements

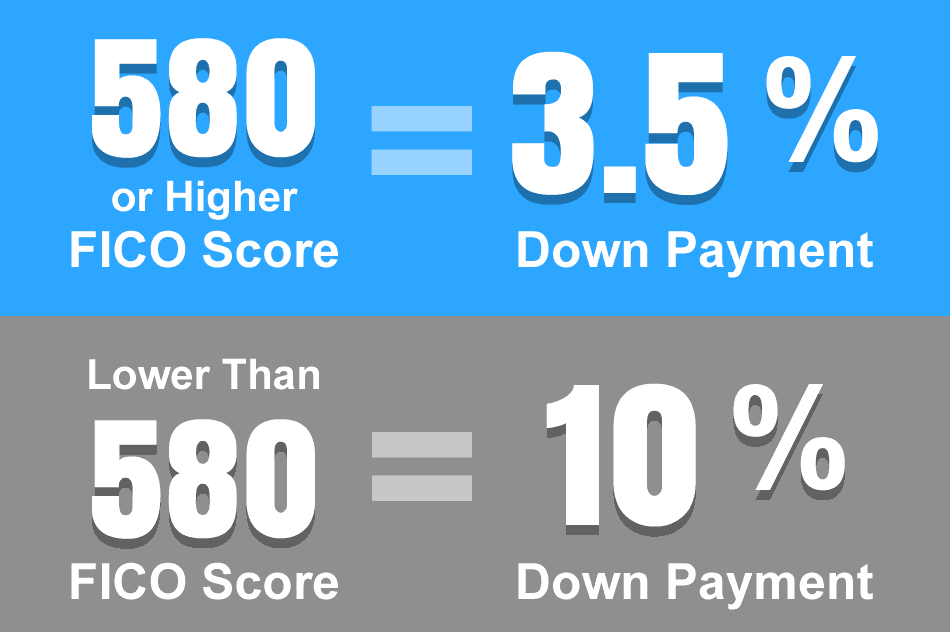

For those interested in applying for an FHA loan, applicants are now required to have a minimum FICO score of 580 to qualify for the low down payment advantage, which is currently at around 3.5 percent.

If your credit score is below 580, however, you aren't necessarily excluded from FHA loan eligibility. Applicants with lower credit scores will have to put down a 10 percent down payment if they want to qualify for a loan.

So if you're planning to buy a house, and your credit score doesn't meet the minimum, you should weigh the advantages and disadvantages of putting down a larger down payment or using those funds to try and improve your credit score first.

Benefits of an FHA Loan

The reason why FHA loans are so popular is because borrowers that use them are able to take advantage of benefits and protections unavailable with most traditional mortgage loans. Loans through the FHA are insured by the agency, so lenders are more lenient. Here are a few benefits you can enjoy with an FHA loan:

- Easier to Qualify

While most loans exclude applicants with questionable credit history and low credit scores, the FHA makes loans available with lower requirements so its easier for you to qualify. - Competitive Interest Rates

You've heard the horror stories of subprime borrowers who couldn't keep up with their mortgage interest rates. Well, FHA loans usually offer lower interest rates to help homeowners afford housing payments. - Lower Fees

In addition to lower interest rates, you can also enjoy lower costs on other fees like closing costs, mortgage insurance and others. - Bankruptcy / Foreclosure

Just because you've filed for bankruptcy or suffered a foreclosure in the past few years doesn't mean you're excluded from qualifying for an FHA loan. As long as you meet other requirements that satisfy the FHA, such as re-establishment of good credit, solid payment history, etc., you can still qualify. - No Credit

The FHA usually requires two lines of credit for qualifying applicants. If you don't have a sufficient credit history, you can try to qualify through a substitute form.

For many homebuyers, using an FHA loan can really make the difference between owning your dream house comfortably or turning it into a financial nightmare. The FHA provides a wealth of benefits for applicants that qualify, so make sure you're making full use of them.

Credit Scores for FHA Loans

SEE YOUR CREDIT SCORES From All 3 Bureaus

Do you know what's on your credit report?

Learn what your score means.

FHA Loan Articles and Mortgage News

July 20, 2024 - When you close an FHA mortgage, you make your down payment and pay closing costs, accept the keys to the home, and prepare to move in. But what should you expect after moving into the new house?

July 19, 2024 - There are many FHA home loan programs, including construction loans and reverse mortgages, which have details some borrowers find confusing. However, assistance is available. HUD-approved housing counseling can greatly help.

July 17, 2024 - What fees and expenses can you expect from an FHA reverse mortgage, also known as an FHA home equity conversion mortgage (HECM)? There are a number of important costs to save for. We examine them in this article.

July 16, 2024 - There are many options to consider when planning your home loan. One good example? Some borrowers wonder if they should choose a 15-year FHA loan over a 30-year mortgage. Those who want to save as much money might consider the 15-year FHA loan, but there are other choices.

July 13, 2024 - According to HUD, the changes announced in early July 2024 modernize the program and enhance its usefulness for individuals and families seeking affordable financing for renovating or rehabilitating a single-family home when purchasing or refinancing it.