FHA Loan Tips for Improving Credit

Track Your Credit Score and Stay on Top of Problems

While FHA loans are known as a great service for people looking for help buying a house, applicants can make the process even easier if they take steps toward ensuring their credit history is in tip-top shape. The agency advises prospective homebuyers to approach FHA loans with their best possible credit history to eliminate any potential risk of not qualifying.

Whether you're looking for a loan to mortgage a new house or to refinance a house you already own, it makes the most sense open up all your options with an optimal credit rating. The FHA recommends having a satisfactory payment history of at least one year before applying for a loan.

Credit Tips for Your FHA Loan

Here are some tips to help you on your way:

- Take a Close Look at Your Credit Reports

You don't know what could be hurting your credit score unless you actually check. Get your credit reports from the three national credit bureaus--Experian, Equifax and TransUnion--at no cost and comb them over for anything suspicious or questionable. - Dispute Inaccuracies

If you find errors on your credit report, notify the reporting bureau in writing so you have a record. Provide any additional records or evidence you have to support your dispute. - Find Professional Help

The FHA recommends applicants with credit problems get help from a Consumer Credit Counseling program. A credit counselor can help you get back on track. - Bankruptcy / Foreclosure

If you've suffered from a bankruptcy or foreclosure in the past few years, you might still be able to qualify for an FHA loan. Develop a satisfactory payment history, re-establish good credit and meet the other FHA requirements.

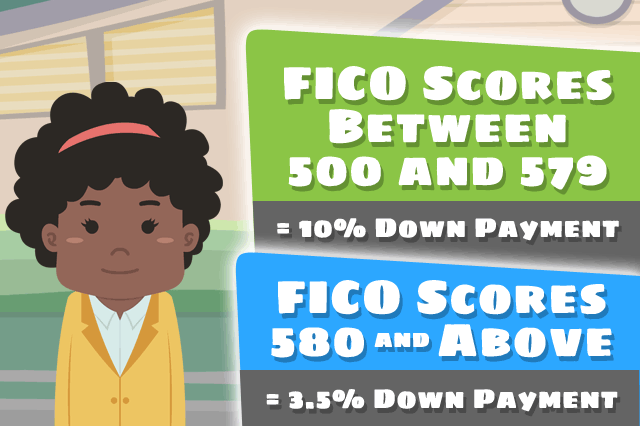

While your credit history is just one of the many factors that make up your eligibility for an FHA loan, it is no doubt one of the most important. Having a higher score not only helps you qualify, you can also benefit from the low 3.5 percent down payment on mortgage loans available to applicants with a FICO score over 580. FHA approved lenders don't take your credit history lightly, and neither should you.

Credit Scores for FHA Loans

SEE YOUR CREDIT SCORES From All 3 Bureaus

Do you know what's on your credit report?

Learn what your score means.

FHA Loan Articles and Mortgage News

July 20, 2024 - When you close an FHA mortgage, you make your down payment and pay closing costs, accept the keys to the home, and prepare to move in. But what should you expect after moving into the new house?

July 19, 2024 - There are many FHA home loan programs, including construction loans and reverse mortgages, which have details some borrowers find confusing. However, assistance is available. HUD-approved housing counseling can greatly help.

July 17, 2024 - What fees and expenses can you expect from an FHA reverse mortgage, also known as an FHA home equity conversion mortgage (HECM)? There are a number of important costs to save for. We examine them in this article.

July 16, 2024 - There are many options to consider when planning your home loan. One good example? Some borrowers wonder if they should choose a 15-year FHA loan over a 30-year mortgage. Those who want to save as much money might consider the 15-year FHA loan, but there are other choices.

July 13, 2024 - According to HUD, the changes announced in early July 2024 modernize the program and enhance its usefulness for individuals and families seeking affordable financing for renovating or rehabilitating a single-family home when purchasing or refinancing it.