FHA Loans Without a Credit History

Typical FHA loan applicant questions in this area go something like this:

"I have old medical bills outstanding but everything else I paid cash for--I feel it unnecessary to have a credit card. Does this hurt my chances at an FHA loan?"

There are many different ways a lender can establish credit history besides credit card activity. Any type of payment such as utility bills, rents, student loans, etc. should all reflect a general pattern of reliability. A year of on-time payments leading up to your application is ideal.

The FHA loan applicant who cannot show at least one year of on-time payments to all creditors in the time leading up to the new loan application may find it difficult to get an FHA loan approved. This is what the FHA loan rulebook, HUD 4155.1, says about a lack of credit history as described above:

The lack of a credit history, or the borrower's decision to not use credit, may not be used as the basis for rejecting the loan application...Some prospective borrowers may not have an established credit history.

The FHA has a procedure in such cases, as described in HUD 4155.1. For these borrowers, including those who do not use traditional credit, the lender must obtain a non-traditional merged credit report (NTMCR) from a credit reporting company, or develop a credit history from:

- utility payment records

- rental payments

- automobile insurance payments, and

- other means of direct access from the credit provider...

------------------------------

RELATED VIDEOS:

Sometimes It Pays to Refinance

Don't Forget Your Closing Checklist

Monthly Payments Establish Good Credit

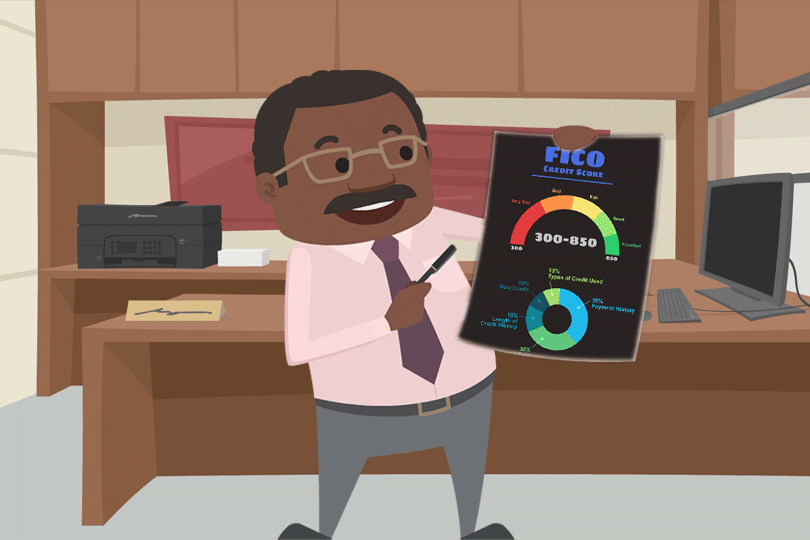

Do you know what's on your credit report?

Learn what your score means.