FHA Loans that Require Escrow

What Is Escrow?

Investopedia describes escrow as a financial agreement “whereby a third party holds an asset or money on behalf of two other parties” to facilitate a transaction like a mortgage.

For FHA home loan transactions, escrow money is paid out under agreed-upon conditions between the lender and borrower.

What can Be Paid for Using Escrow?

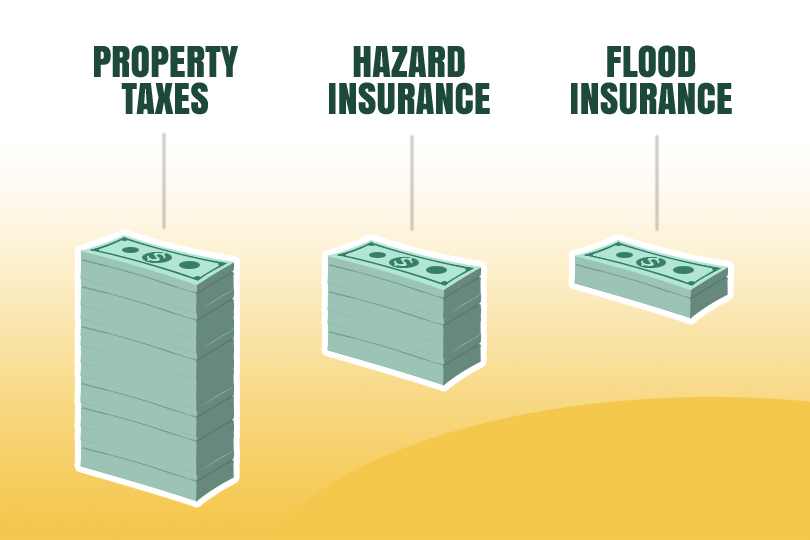

The most common uses for escrow for an FHA mortgage are property taxes, paying contractors for labor or materials, and good faith deposits. Some FHA loans have specific uses for escrow that others don’t as we will see below.

FHA Loans and Escrow for Purchases

Property taxes, mortgage, and homeowners insurance may be paid via escrow for FHA purchase loans.

Escrow may also be needed when the borrower opts into FHA loan add-ons like the FHA energy-efficient mortgage option, which allows extra money for approved home upgrades.

Escrow gor FHA Construction Loans and Rehab Loans

Escrow accounts for FHA 203(k) rehabilitation loans and One-Time Close construction loans, which are typically used to pay contractors for labor and materials.

These payments are called “draws.” The money goes directly from escrow to the contractor or supplier. At no time does the money pass through the loan applicant’s account, nor do loan funds get paid directly to the borrower.

Escrow for FHA Reverse Mortgages

A reverse mortgage is one where the borrower, aged 62 or older, who owns the home outright or is close to doing so, applies for a mortgage that pays the borrower cash based on the equity in the home.

The loan is payable once the borrower dies or sells the home. The loan can also be due in full if the borrower does not abide by the loan terms, which include using the home as the primary residence and staying current on all property tax obligations.

The property tax issue is handled via escrow, and borrowers are typically required to use escrow to pay property taxes on homes secured by an FHA reverse mortgage.

------------------------------

RELATED VIDEOS:

Your Mortgage Payment Schedule Is Called Amortization

Information About the Balloon Payment

Reliable Borrowers Can Qualify for a Cash-Out Refinance

Do you know what's on your credit report?

Learn what your score means.