Home Loan Down Payment Issues You Should Know

Here’s what you need to know about making a down payment on these types of home loans.

Conventional Loan Down Payments

You may be able to find a conventional loan at or near the FHA’s 3.5% down payment, but keep in mind that unless you pay 20% down, you face a mortgage insurance requirement.

Your cash-to-close and down payment are typically separate, and you should expect to have your down payment funds reviewed and approved by the lender.

That review process is typical regardless of what type of home loan you seek, but specific requirements may vary from lender to lender.

USDA Down Payment Requirements

USDA loans typically feature no down payment requirement, but these mortgages are need-based and feature income caps and other restrictions.

VA Home Loan Down Payment Requirements

If you are a typical VA borrower, you may be able to take advantage of the VA’s no down payment option for VA mortgages, but remember that if you buy a home where the asking price is higher than the appraised value, you will be required to pay the difference in cash at closing time.

VA mortgages have no VA-required mortgage insurance, so that is an expense typical borrowers won’t have to deal with under the VA mortgage program.

FHA Home Loan Down Payment Requirements

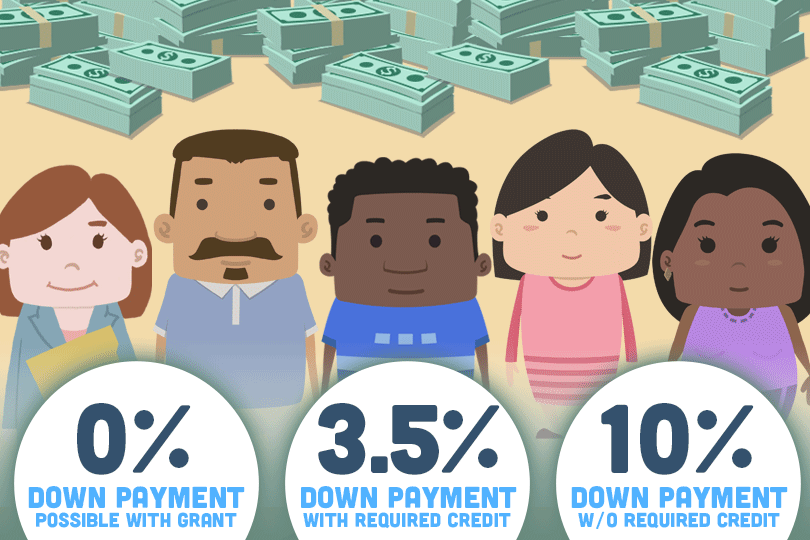

FHA mortgages typically require 3.5% down for those who qualify with FICO scores at 580 or higher. That’s the FHA standard, not your lender’s, which may vary.

FHA loans require 10% down for those applying with FICO scores between 500 and 579. FHA loans require upfront mortgage insurance and a recurring mortgage insurance premium for 11 years or the loan's lifetime.

That duration is dependent on the down payment amount and other variables. Always ask a potential lender to compare these requirements for each loan to understand better how much your loan could cost.

------------------------------

RELATED VIDEOS:

Disclosures Give Transparency to Borrowers

Understanding the Purpose of Your Mortgage Down Payment

Putting Money Into Your Escrow Account

Do you know what's on your credit report?

Learn what your score means.