First-Time Homebuyers and Their FHA Loan Options

FHA Loan Types

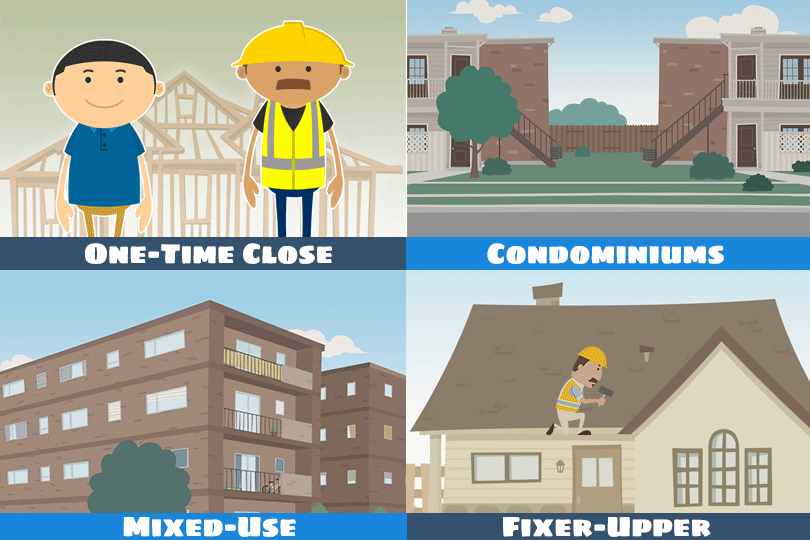

There’s no single FHA loan for all needs. You will need a different loan for a condo than you would to build a house on your own lot using an FHA One-Time Close construction loan. There are also different FHA loan limits depending on whether you buy a single-unit home or one with as many as four living units.

FHA loan official resource: Buying a Single Family Home

Buying a manufactured home is also an option under the FHA loan program, but there are some considerations you should know, including a limit on the age of the home and the requirement that it be placed on an approved permanent foundation.

FHA loan official resource: Buying a Manufactured Home

The key is to let your participating lender and real estate agent know which property type you want and talk about the right loan for that purchase.

FHA Loan Purposes

You can buy or build a single-unit home, or buy a multi-unit property as mentioned above, but your intent to occupy is key. If you don’t plan on living in the house you want to buy, an FHA mortgage or other government-backed option isn’t open to you. Investment properties are outside the scope of the FHA Single Family Home Loan program.

But you are permitted to live in a multi-unit home purchased with an FHA loan and rent out the other unused units.

FHA Loans For Seniors

One aspect of the FHA loan program is the FHA Reverse Mortgage, also known as a Home Equity Conversion Mortgage (HECM).

This type of refinancing is offered to those 62 or older who own or are close to owning their homes. A reverse mortgage has no monthly payments, and the loan is due when the borrower dies, sells the home, or no longer uses it as their primary residence.

What you should know about this home loan option includes an FHA requirement for borrower counseling as a requirement for loan approval, and the previously mentioned requirement for occupancy. You can’t use an FHA HECM loan for a property you don’t live in the home full-time.

Official FHA resource: FHA Reverse Mortgages

------------------------------

RELATED VIDEOS:

Home Equity Can Secure Your Second Mortgage

Consider the Advantages of Discount Points

FHA Limits are Calculated and Updated Annually

Do you know what's on your credit report?

Learn what your score means.