Buying Your First Home with an FHA Loan

No Early Payoff Penalties on FHA Mortgages or Refinance Loans

FHA loan rules don’t allow the lender to charge a penalty for paying off your loan early, whether that means paying extra on your mortgage payment every month, refinancing the loan, or selling the house.

- The lender can’t penalize you for paying your mortgage off ahead of schedule or making extra payments.

- Some borrowers split their mortgage payment in half and pay once every two weeks, which adds an extra mortgage payment per year.

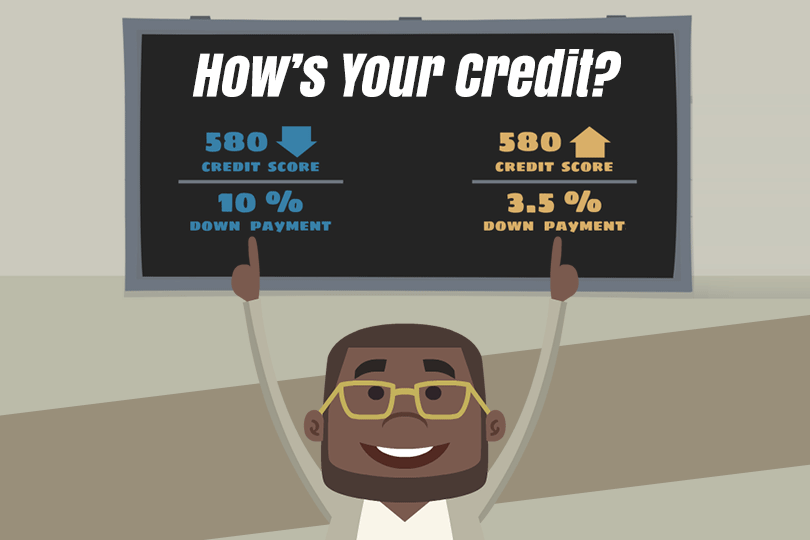

FHA loans require a minimum FICO score of 580 or higher for the lowest down payment.

- If your FICO scores are between 500 and 579, FHA loan rules say you must pay 10% down.

- Lender standards will also apply, so make sure you ask what those additional standards might be.

- Typical lenders may require FICO scores in the 600 range.

FHA mortgage loan rules in HUD 4000.1 state that a borrower should have two years of employment history, though you don’t have to have that history with just one employer.

- Frequent job changes may be an initial concern, but they may be acceptable to FHA lenders if you have been upwardly mobile during those job changes.

- Your employment record will be reviewed and if you have concerns about that history, consider explaining (in writing) any circumstances that might need more clarification.

- FHA loan rules have certain flexible income guidelines intended for seasonal workers, people earning commissions, self-employed applicants, and freelance/contractors to qualify for a home loan.

Mortgage Loan Interest Rate Issues

Your FICO scores play an important role for the lender when it’s time to offer a mortgage loan interest rate.

The lower your rate, the more you save over the lifetime of the mortgage. Some FHA borrowers choose a fixed-rate mortgage because they want to keep the home for a long time.

But when interest rates are high, an FHA adjustable-rate mortgage can help; these loans have a lower introductory rate; adjustable-rate mortgages are best for borrowers who make a plan to deal with the interest rate adjustments once they start. It’s best to sell, refinance, or pay more each month on your mortgage once those rate changes begin.

------------------------------

RELATED VIDEOS:

What You Need to Know About the Appraisal Fee

The Appraisal is an Important Requirement

Build Your Dream Home With a One-Time Close Loan

Do you know what's on your credit report?

Learn what your score means.