FHA Loan Down Payment Facts

Knowing the down payment rules before you start saving for your home loan may make the entire process more efficient, especially if you know you’re required to give the lender the sources of your down payment money and document it accordingly.

FHA Down Payments: Sourcing Required

You can’t just write a check to your financial institution and say, “That’s my down payment!”

Your lender has to verify the sources of your down payment funds to ensure they don’t come from credit card cash advances, payday loans, or someone who has a financial stake in the outcome of your home loan.

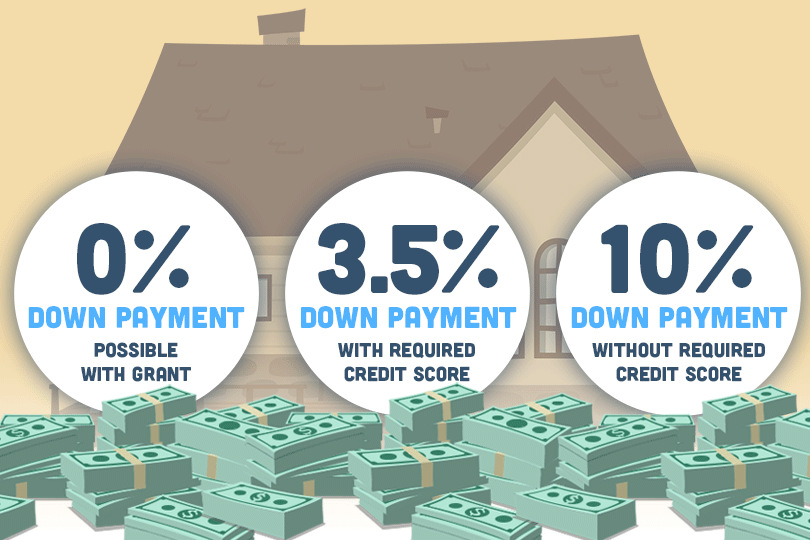

FHA Down Payment: 3.5% or 10%

Unlike some government-backed mortgages, your FHA loan down payment is either 3.5% or 10% depending on FICO scores and other variables. If you are applying for a construction loan, lender standards may require you to use your own funds and not rely on down payment assistance.

FHA Loan Down Payments: You Can Get Assistance from Friends and Family

Remember that the same sourcing rules (no payday loans, all funds must be properly sourced) for down payment help from friends and family will apply. They must show the sourcing of their down payment gifts. There is another rule to be mindful of here. Down payment gifts cannot be loans in disguise.

Higher Down Payments

Making a higher down payment isn’t always possible. But for those who can do it, paying more upfront potentially lowers your monthly payment, but more importantly, it can save you money over the loan's lifetime in interest payments.

Some borrowers may be required to make a higher down payment as a compensating factor in cases where the borrower’s FICO scores do not qualify for the lowest down payment amount.

Down Payments: Separate from Other Closing Costs

Some new borrowers want to know if their earnest money, closing costs, or lender fees count toward their FHA home loan down payment. The short answer is no; these payments are not counted toward your down payment amount. Expect to save or raise funds for your entire down payment and closing costs.

------------------------------

RELATED VIDEOS:

Don't Skip the Home Inspection

Bigger is Better With a Jumbo Loan

Insuring Mortgages With the FHA Funding Fee

Do you know what's on your credit report?

Learn what your score means.