Planning for Your FHA Mortgage

There are phases and stages in the home loan process and you will want to have enough prep time before each one. FHA home loans have more forgiving credit requirements, but some concerns will apply regardless of credit score issues.

One important area to think about when you are in the planning stage of the home loan process? Working out a new budget that includes the saving you will need to do in order to get ready for the home loan.

And making choices about how much home loan you can afford and what kind of loan to get isn't just about how your finances look today--you will need to look to the future to get an idea of what the lender will be thinking about for loan approval.

What kind of forward-thinking are we talking about here? Think in terms of your job, income, scheduled raises or promotions, anything that might help your loan officer justify approving your home loan.

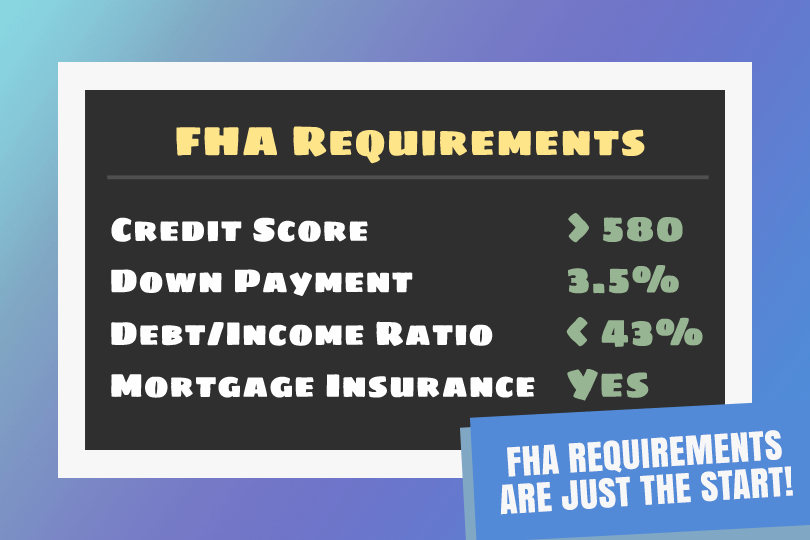

One area your lender will pay close attention to? Your debt-to-income ratio or DTI. How does your DTI look now and will it be allowed in the months ahead?

DTI is a major factor for your lender when determining whether or not to approve your application for the mortgage. You want your outgoing debt to take up less than 50% of your income (below 41% is better) every month, or work toward doing so.

When it is time to start thinking about monthly budgets after the loan has closed and your mortgage payments start coming due, you may want to get an estimated loan amount to shoot for and determine how much mortgage you could afford to pay every month. You can use an online mortgage calculator to help you get this estimate.

When doing those calculations, consider your alternative options in case you decide to go with a co-borrower or seek downpayment assistance for the loan. Running those numbers will give you a more informed idea of how much the loan could cost you with or without the co-borrower or down payment help.

While still in the budgeting and planning phase of your homeownership journey, it is a very good idea to anticipate your closing costs and start saving for them. While some closing costs may be financed into the loan, not all are approved. And the more you add to your mortgage amount, the higher your monthly payments potentially go.

By choosing what to add to the loan carefully you can strike a better balance between upfront costs and your monthly mortgage payment. Anticipating these choices early is a very good idea.

------------------------------

RELATED VIDEOS:

Learn How to Meet FHA Requirements

A Few Tips About Your Fixed Rate Mortgage

Your Proof of Ownership Is the Property Title

Do you know what's on your credit report?

Learn what your score means.