Common Homebuyer Mistakes You Can Avoid

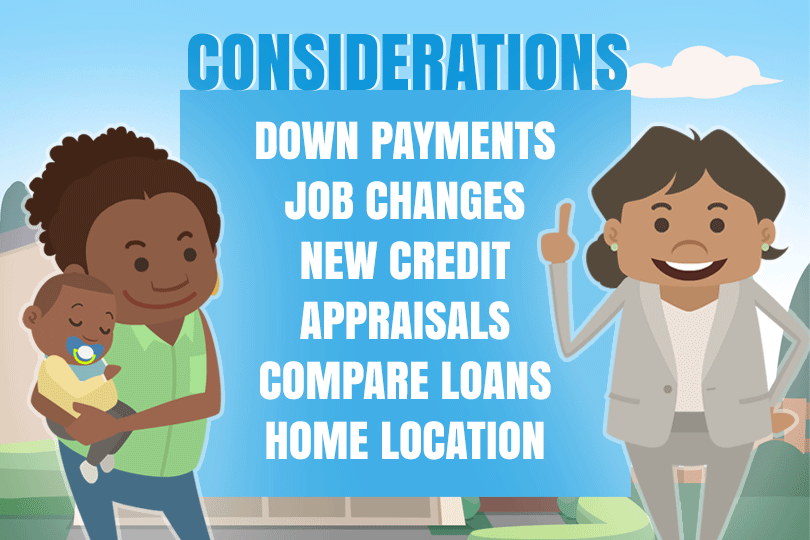

A big mistake some borrowers make is accepting down payment money from a friend, family member, or even an employer without knowing or asking for such documentation. You can ask your participating lender what should be submitted, and you’ll need to make sure you follow those instructions to the letter.

But that’s only one mistake that can trip you up on the way to closing day. Another one is quitting the job you had when applying for the loan and moving into a different kind of work.

It’s not necessarily a deal-breaker to make an upward move in your career but you should ask your lender what happens if you must face such a choice after you’ve applied for the loan but before closing day.

Some make the mistake of applying for new credit while waiting for their home loan to close. Don’t do this, as it forces the lender to reevaluate you as a potential borrower under the right circumstances.

Some make the mistake of assuming that an FHA appraisal offers the same information as a home inspection. It does not, and those who rely on the appraisal alone are setting themselves up for huge disappointments down the line.

Another big mistake some house hunters make on the road to owning their own home? Not comparing all home loan options.

For example, you could apply for a conventional mortgage, but if the down payment requirement seems too much, an FHA mortgage with the minimum 3.5% down payment might make more sense. It’s good to compare all your loan options, even ones you think you might not need like an FHA 203(k) Renovation mortgage to buy a fixer-upper.

Here’s a mistake some borrowers make that isn’t commonly discussed in the laundry list of things to avoid doing ahead of your closing day; not asking about issues related to the location of your potential new dream home.

Ask the seller if the home is currently carrying any hazard insurance for rising water or other natural disasters and ask specifically if the home is in a known disaster area or a region prone to certain types of heavy weather.

But you won’t want to stop with asking the seller. Ask your lender, a real estate agent, and anyone else who might be knowledgeable. It’s not that you cannot trust a seller or any other individual in the process, it’s that you want a well-rounded picture of the home you are buying and the area where you will be living.

Ask many people such questions and make the most informed choice you can.

------------------------------

RELATED VIDEOS:

Don't Skip the Home Inspection

Bigger is Better With a Jumbo Loan

Insuring Mortgages With the FHA Funding Fee

Do you know what's on your credit report?

Learn what your score means.