Prepare for Your Home Loan Application: Important Things to Work On

Ideally, you want to begin prepping for the loan as early as possible. There are good reasons to start a year or more in advance. You want to have plenty of time to save money for your FHA mortgage loan minimum of 3.5% down payment plus the closing costs, and other loan expenses such as the appraisal and home inspection.

Never skip the home inspection, even though it is technically considered an optional expense. Relying on the appraisal alone is a recipe for disaster and many buyers have learned this the HARD WAY. Don’t be like them.

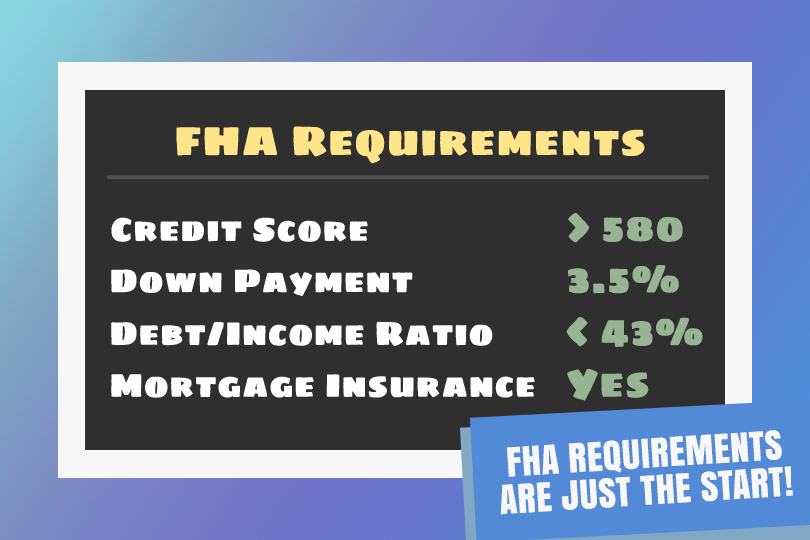

There are basic areas you should pay attention to in the planning stages of your home loan for best results. You’ll want to focus on your savings, your debt, and your credit scores.

Working on Your Credit Scores

The borrower who does not begin monitoring credit, and fails to be proactive in reducing credit use and working on lowering credit card balances as far below the 50% line of your credit limit as possible? These borrowers will realistically face a harder time qualifying for the mortgage they want.

And working on your credit is easier than some believe. Some consumers choose to schedule their monthly payments so that their bills are paid off before the due date, every time using automatic deductions to keep the payments consistent. Consistency in your payments is key.

And what about taking a more ambitious approach toward credit card debt--paying off the smallest credit card first and working on the next one from there? This can help too but remember that you’ll likely need more time than anticipated to make this work. There is nothing wrong with taking the extra time, either.

Making consistent, on-time payments will help improve your credit scores over time. So does cutting down your credit card debt. The more time you allow yourself to work on this, the better--begin looking at your credit reports and spending habits at least a year ahead of time or more.

Saving for Your Down Payment and Closing Costs

The extra time is also handy for saving funds for your loan expenses--you will need to take time to build up your savings to pay for the closing costs of your mortgage, and the down payment issue is something to address early, too.

It is a smart move to seek out a down payment assistance program in your local area. Getting down payment and/or closing cost help means more money is freed up for other parts of your loan or could even be set aside for post-closing expenses such as moving or furnishing the home.

While it is true that those programs are, in some cases, intended for first-time borrowers, but there may be a first-time buyer down payment grant and closing cost help offered to those who have not owned property in the last three years. In essence, these programs may treat you like a first-time borrower if you meet the three-year requirement.

------------------------------

RELATED VIDEOS:

Know What's On Your Credit Report

FHA Loans Have Credit Requirements

Help Is Available With Down Payment Grants

Do you know what's on your credit report?

Learn what your score means.