Review Your Credit Report Before You Commit to a Home Loan

A major reason it is so important to do this? The advice you get every article with advice on this topic is to start reviewing your credit early in case you have to dispute an item on your report. And there is a very good reason why that advice is repeated so often--you need to know what the report says about your credit habits, credit card use, your FICO scores, etc.

But what happens if you discover outdated information, evidence of identity theft, or errors in the report? It can and does happen and you should be prepared to deal with these potential issues in your credit reports.

Don't forget that you should check all three credit reporting agencies to determine if the errors are on multiple credit reports. They often are. You will want to review both your credit data and personal information to ensure accuracy.

Each credit reporting agency should have a complaint section or a dispute center where you can report issues associated with your credit reports.

Consumers are required by law to receive free credit reports each year but access to these credit scores and other information is not automatic--you must claim your free copies.

When reviewing a credit report, you should seriously consider signing up for credit monitoring and setting up fraud alerts on your file. Your credit history may be verified today, but what issues may crop up in the future?

You will be required to start a new claim if there are issues with your report. Be sure to ask how to submit complaints as you may need to follow a specific procedure.

You may be instructed to submit supporting documentation to back up your claim. You may need to provide explanations and you will need to send copies (never originals) of any paperwork you have as evidence.

This can include your tax records where applicable, information about past creditors, copies of your Social Security Number or any other required information.

It is not advisable to try and proceed with a major loan application such as an FHA mortgage or even an auto loan if you have disputed a portion of their credit report(s). But until your dispute has a resolution, filling out home loan paperwork is a bad idea.

Your lender may not be able to proceed with the new loan until the process is complete. You may find information online suggesting the process can be quick--Experian, for example, says the company tends to settle all disputes in approximately one month but that said, you could find there are complicating factors that can make the process take longer.

Expect delays and don't assume you can get the complaint resolved while trying to beat a deadline for your home loan process. Start early, and don't apply for new credit until you have resolved the issues surrounding your credit accounts first.

------------------------------

RELATED VIDEOS:

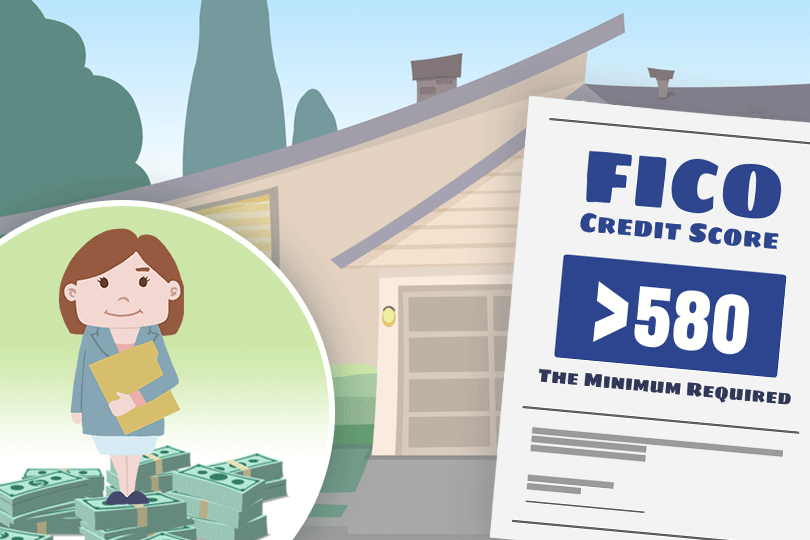

FHA Loans Have Eligibility Requirements

The U.S. Government Backs Mortgages Through the FHA

Financed Properties Must Meet FHA Minimum Standards

Do you know what's on your credit report?

Learn what your score means.