What to Think About Before Applying for Your Home Loan

What do you need to think about before applying for an FHA home loan? A lot of people make checklists to help them remember all the steps they need to take to prepare. And the individual steps can require more time that some anticipate.

For example, when preparing your credit for the loan you need to not only know the contents of your credit report but you will also need to monitor your credit through the entire home loan experience for best results.

Some borrowers don’t realize their lender may check their credit more than once during the loan transaction. Does that surprise you?

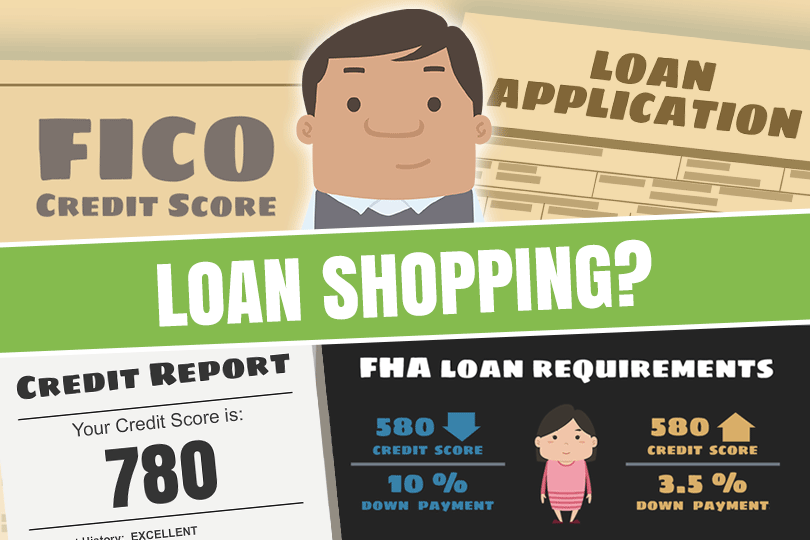

Knowing what your credit report says and your current FICO scores is vital for a mortgage borrower and home buyer.

But knowing the data is only half the battle sometimes--what happens if your credit report reveals signs of identity theft or if you notice errors showing up in your report over time? It can and does happen.

When you are planning your loan, shopping around for the right mortgage lender and getting your down payment issues sorted out, one important thing to remember? When you begin saving for that down paymentm, keep detailed records of the down payment money including the source of the funds, date deposited, and any other pertinent information.

Why so much record-keeping?

Your lender is required to obtain proof that your down payment funds did not come from unapproved sources.

Those prohibited sources? The seller of the property, any non-collateralized loans, pink slip loans, etc. In general it is best to prevent large, unexplained deposits into the account where you are saving your down payment funds

And what about indicators of your ability to afford the loan and keep making payments in the mid-term? Do you have a large cash reserve you could use to make mortgage payments with down the road? That is useful as a compensating factor for the lender--if you are worried about low credit scores, that is a factor that may help.

There are other money considerations--what about cases where a borrower has a job change such as switching from salary to commission income? Have you gone from being a contractor to an employee recently? In the last year or so? You'll want to save the documentation that shows how and when these things happened--in some cases, your lender may need that information to sign off on your loan amount, issue approval letters, etc.

Always assume your lender will need documentation for any such issue and keep good records accordingly. This will come in handy when you do feel ready to apply for the loan--your collection of records, bank statements, and on-time payments will go a long way toward helping you get into your new home.

------------------------------

Learn About the Path to Homeownership

Take the guesswork out of buying and owning a home. Once you know where you want to go, we'll get you there in 9 steps.

Step 1: How Much Can You Afford?

Step 2: Know Your Homebuyer Rights

Step 3: Basic Mortgage Terminology

Step 4: Shopping for a Mortgage

Step 5: Shopping for Your Home

Step 6: Making an Offer to the Seller

Step 7: Getting a Home Inspection

Step 8: Homeowner's Insurance

Step 9: What to Expect at Closing

Do you know what's on your credit report?

Learn what your score means.