How Much Do I Need to Put Down on a House?

Because borrowers who need to keep their monthly payments low may wish to factor in how low those payments could be with the right down payment.

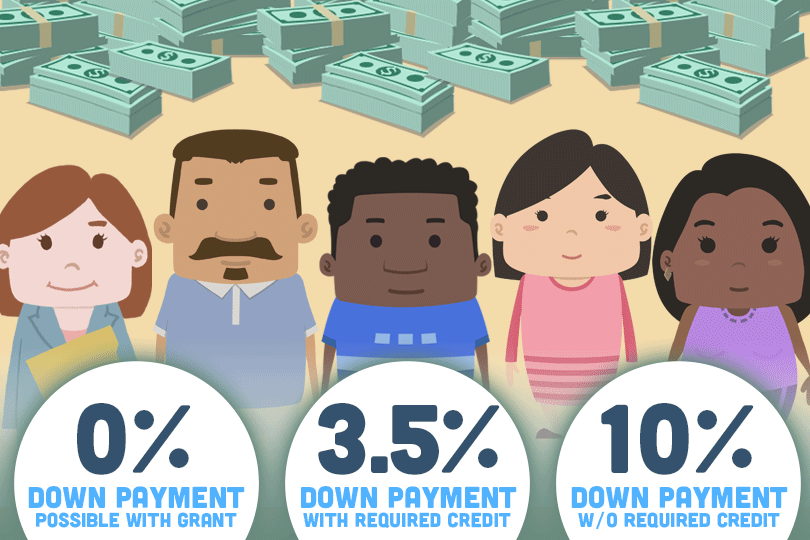

Your credit score helps determine the interest rate you are offered for an FHA loan. It also determines your minimum down payment at 3.5% or 10% depending.

20% Down for a Mortgage?

Some people have grown accustomed to thinking that the down payment amount they NEED to pay is 20%. But as mentioned elsewhere, 20% down is a requirement conventional lenders generally give when the borrower wants to avoid private mortgage insurance.

Mortgage loans require a down payment of a larger size when there is increased risk to the lender or in cases like these where the borrower wants to realize a benefit from doing so.

FHA Loans Aren’t the Only Loans to Reward a Larger Down Payment

FHA loans aren't the only ones that reward people for making down payments or making larger-than-needed down payments. Did you know VA loans offer a reduced VA funding fee for those who seek to lower their mortgage payments by putting a certain percentage down?

The benefits of making a larger down payment include a smaller loan amount, which means your interest rate charges will be lower over the duration of the mortgage.

A homebuyer does well to at least consider this as an option even if in the end she decides not to.

Homebuyer Assistance Programs

Home buyers interested in saving money up front on the mortgage can still consider making a larger down payment--down payment assistance programs offered by your state or local agencies can help with these upfront payment requirements.

Indeed, some of these assistance programs actually do require some form of personal investment from the borrower. The dollar amounts or percentages will vary with these programs just as mortgage loan terms vary from mortgage lender to lender.

Loan programs and their features vary, which is why it is a very good idea to compare your down payment options carefully before you commit to a home purchase.

The Federal Housing Administration advises borrowers to shop around for a real estate agent, a lender, and a home with equal enthusiasm--you will be very glad you did.

------------------------------

RELATED VIDEOS:

There's a Difference Between APR and Interest Rates

Choose Your Mortgage Lender Carefully

Getting Started With Your FHA Loan Application

Do you know what's on your credit report?

Learn what your score means.