Monitoring Your Credit Before a One-Time Close Construction Loan

This is especially important for construction loans as your lender may have a higher FICO score requirement for these loans. Credit monitoring can help you stay on top of your credit scores and take steps to keep you credit report in good shape by addressing potential identity theft, ensuring errors and old data get removed from your file, etc.

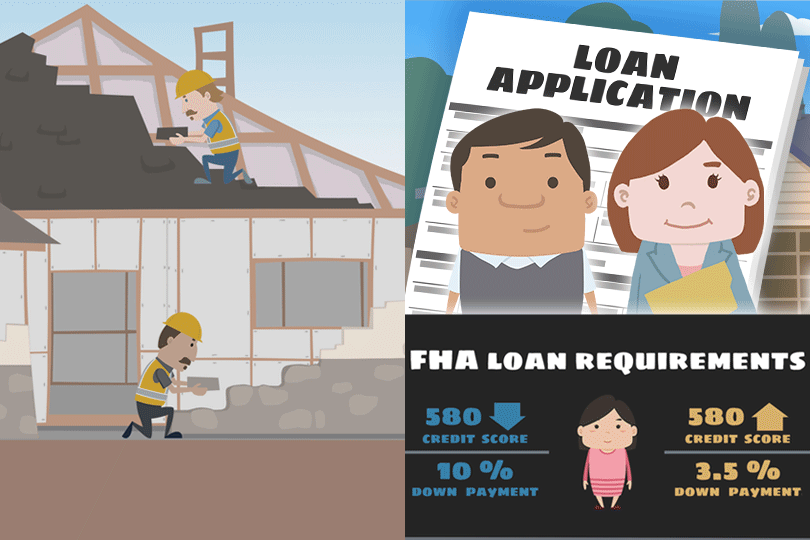

One-Time Close loans under FHA and even VA loan programs do feature lower FICO score requirements than many conventional loan equivalents. But these loans are a bit more specialized and if you don’t address potential credit issues early you could find your loan process delayed or even halted until those issues are resolved.

Keep in mind that your credit report may be constantly updated, and if you don’t monitor your report you could find nasty surprises later that need dealing with. How much time is lost by people who didn’t know certain changes on their report showed up when they weren’t looking? Active credit monitoring is the key to preventing this.

Even a case of outdated information that needs to “fall off” your credit report could take longer than you realize to settle with the credit reporting agencies and that’s a good reason to start looking at your credit early.

Some credit monitoring programs include spending trackers that can be a big help to a potential borrower. If you’re trying to find ways to cut your monthly debts and save more for your mortgage loan, you can find ways to cut corners and budget more efficiently with such a tracker.

Monitoring your credit isn’t a magic bullet; in addition to knowing the contents of your report and tracking any changes along the way, you’ll need to reduce your debt-to-income ratio and avoid opening new lines of credit before you apply for the construction loan.

You should also be a bit more aggressive about saving for your down payment and closing costs; participating lenders are likely to not allow you to use down payment assistance programs in conjunction with an FHA One-Time Close loan or a VA OTC mortgage.

Construction loans are more rigorous in some ways than loans to buy existing construction. It takes time to approve the plans for the home, find the right contractors, and the construction process itself can be time consuming.

As a result there may be more scrutiny on such loans, but for borrowers who take the time to save and prepare for the construction loan, the extra effort pays off in the form of a customized home built to the borrower’s specifications. That’s an outcome that attracts many to building rather than buying existing construction.

FHA, VA, and USDA: One-Time Close Loans

FHA, VA, and USDA: One-Time Close Loans

Learn More About FHA One-Time Close Construction Loans

We have done extensive research on FHA One-Time Close mortgages and spoke directly to the licensed lenders for most states. These are qualified mortgage loan officers who work for lenders that know the product well.

Each company has supplied us the guidelines for their product. If you are interested in being contacted by one licensed lender in your area, please respond to the below questions to save time. All information is treated confidentially.

Your response to [email protected] authorizes FHA.com to share your personal information with a licensed mortgage lender in your area to contact you.

Please note that the FHA One-Time Close Construction Program only allows for single family dwellings (1 unit) – and NOT for multifamily units (no duplexes, triplexes or fourplexes).

1. Send your first and last name, e-mail address, and contact telephone number.

2. Tell us the city and state of the proposed property.

3. Tell us your credit score and/or the Co-borrower’s credit score, if known. 620 is the minimum qualifying credit score for this product.

4. Are you or your spouse (Co-borrower) eligible veterans?

5. If either of you are eligible veteran’s, the down payment is $0 up to the maximum VA lending limit for your county. If not, the FHA down payment is 3.5% up to the maximum FHA lending limit for your county.a href="https://www.youtube.com/watch?v=7gpbS2Dkqw8">Buying a Home With a Co-Borrower

Do you know what's on your credit report?

Learn what your score means.