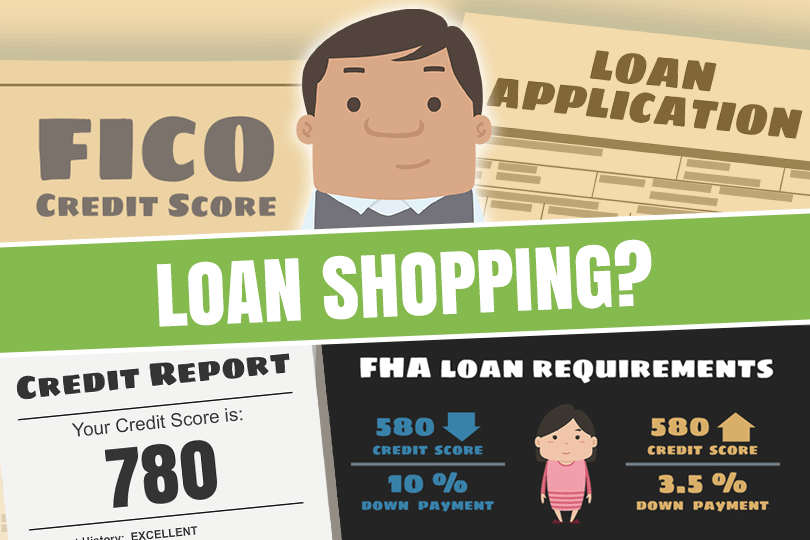

Does Shopping Around for an FHA Lender Hurt My Credit Score?

When you shop around for an FHA lender, you may be required to fill out online forms requesting your personal information including projected house prices, your income and assets, credit score, etc.

Some borrowers worry that doing this with multiple lenders will negatively affect their credit score. After all, we are told that when you apply for any new credit, the hard inquiry on your credit report can lower your FICO score a bit and if you look at five different lenders it would be easy to assume you are damaging your credit scores every time you fill out forms for a different lender.

What is the reality?

The leading credit agencies (Equifax, Experian, TransUnion) as well as the federal government’s own official websites remind potential borrowers that as long as you are shopping around for a lender within a 45-day window, multiple credit checks are applied to your credit report as a single credit inquiry.

The Consumer Financial Protection Bureau reminds us, “This is because other creditors realize that you are only going to buy one home. You can shop around and get multiple preapprovals and official Loan Estimates.”

The effects of doing so on your credit is the same no matter how many lenders you try within that 45 day window of time from the very first credit check. That is a very important factor to remember--you will need to note the date of the first credit inquiry and respond accordingly with your other research into different lenders.

One issue that’s easy to overlook? The fact that this 45-day window is ONLY applicable for credit checks from mortgage lenders or brokers. Credit card inquiries and similar transactions are NOT included in this 45-day window and are handled completely separate from your mortgage credit inquiries.

The bottom line? You will need to plan carefully when shopping around for a lender to make sure you get the most mileage out of this 45-day window of opportunity.

Don’t approach this important part of the home loan process without a plan--the more prepared you are, the better. If you have already filled out some loan paperwork with one lender and want to investigate your options a bit later on, be sure to note when you made your first inquiry of a lender and back-time your subsequent efforts to try to stay within the 45 days.

------------------------------

RELATED VIDEOS:

Let's Talk About Home Equity

Understanding Your Loan Term

Your Home Loan is Called a Mortgage

Do you know what's on your credit report?

Learn what your score means.