Buying or Building a Home: Credit Checklist

What things do you need to pay attention to with your credit ahead of your mortgage application? You can make a handy checklist to follow as you prepare for a home loan.

1. You Must Ask Yourself...

There are a few questions you should ask yourself before applying for the mortgage. One biggie? Whether or not you have co-signed with anyone on a different type of loan or other financial obligation.

If the answer is yes, you’ll want to check in with your co-signer to make sure that the payments have been made on time, and for how long. If you become (or have become in some cases) liable for the debt, it could work against you in terms of establishing your debt-ratio.

It's best to ask a lender’s advice about what to do about a co-signing agreement you have with a spouse, co-worker, friend, or family member. The laws of your state will also be very important in this department.

Also ask yourself if you have had any late or missed payments in the last 12 months--you’ll want to come to the loan application process with at LEAST 12 months of on-time, every time payments on the books. If you can’t do that just yet, it is a very good idea to delay filling out loan paperwork until you can.

2. Mortgage Loan Credit Checklist: Credit Monitoring

If you have not started actively monitoring your credit (there are subscription services you can use to do this) you likely are not prepared to have your credit scrutinized by the lender. Start monitoring your credit as soon as you have decided to commit to buying a home, even if those plans are far in the future.

Credit monitoring is an excellent way to avoid bad surprises at loan application time. Know the contents of your credit report and you will have a much easier time getting ready for your mortgage assuming you don’t have to fix some issue with your credit report or scores.

3. Credit Checklist: Check Your Balances

One important factor in preparing your credit for any major investment including a home loan involves knowing your credit limits on all accounts, and how close you are to those limits.

The lender does not like to see potential borrowers running up credit card accounts (especially multiple near-the-limit accounts) close to the maximum credit limit; work on reducing your balances to get them well below 50% of the limit for best results. The lender must perform a debt-to-income calculation as well as consider your credit utilization to determine how well a borrower manages their credit.

4. Don’t Add New Credit Until After Your Mortgage Loan Closes

In addition to the credit utilization issues, you’ll need to beware of adding new accounts, cards, etc. in the months ahead of your mortgage loan application. This is crucial overall, but especially important in the weeks and months between applying for a mortgage and the loan’s closing date (assuming the loan is approved).

Some borrowers might think the lender won’t check again once the initial credit inquiry has been run, but this is NOT TRUE. Your credit will be reviewed a second time before the loan closes--don’t give the lender a reason to deny your mortgage at the last moment.

FHA, VA, and USDA: One-Time Close Loans

FHA, VA, and USDA: One-Time Close LoansWant More Information About One-Time Close Loans?

We have done extensive research on the FHA (Federal Housing Administration), the VA (Department of Veterans Affairs) and the USDA (United States Department of Agriculture) One-Time Close Construction loan programs. We have spoken directly to licensed lenders that originate these residential loan types in most states and each company has supplied us the guidelines for their products. We can connect you with mortgage loan officers who work for lenders that know the product well and have consistently provided quality service. If you are interested in being contacted by a licensed lender in your area, please send responses to the questions below. All information is treated confidentially.

FHA.com provides information and connects consumers to qualified One-Time Close lenders in an effort to raise awareness about this loan product and to help consumers receive higher quality service. We are not paid for endorsing or recommending the lenders or loan originators and do not otherwise benefit from doing so. Consumers should shop for mortgage services and compare their options before agreeing to proceed.

Please note that investor guidelines for the FHA, VA, and USDA One-Time Close Construction Program only allow

Your email to [email protected] authorizes FHA.com to share your personal information with a mortgage lender licensed in your area to contact you.

- Send your first and last name, e-mail address, and contact telephone number.

- Tell us the city and state of the proposed property.

- Tell us your and/or the Co-borrower’s credit profile: Excellent – (680+), Good - (640-679), Fair – (620-639) or Poor- (Below 620). 620 is the minimum qualifying credit score for this product.

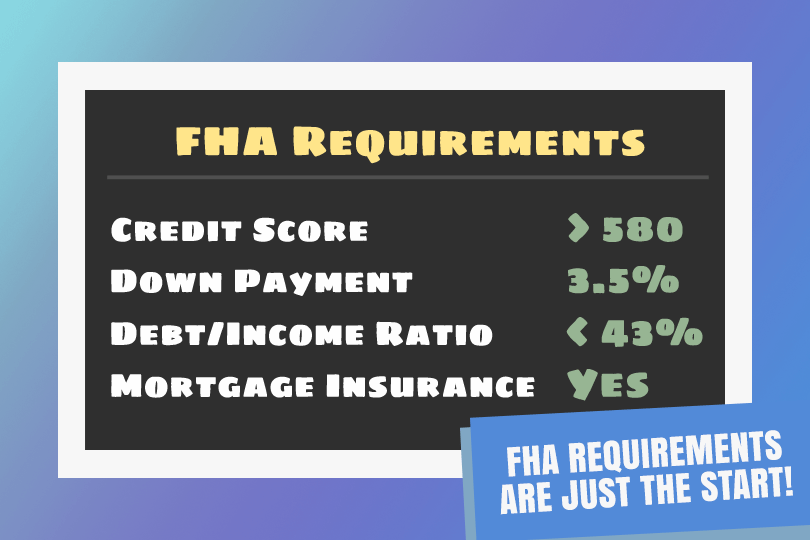

- Are you or your spouse (Co-borrower) eligible veterans? If either of you are eligible veterans, down payments as low as $0 may be available up to the maximum amount your debt-to-income ratio per VA will allow – there are no maximum loan amounts as per VA guidelines. Most lenders will go up to $750,000 and review higher loan amounts on a case by case basis. If not, the FHA down payment is 3.5% up to the maximum FHA lending limit for your county.

Do you know what's on your credit report?

Learn what your score means.