Preparing For Your Home Loan: Credit Issues

You may feel ready for a new loan, but if you don’t know the contents of your credit report you really aren’t ready to apply for a mortgage yet. Do you know what to do if your credit report needs correcting?

The first step in determining whether your credit truly is ready is to review the contents of your credit report. That’s advice we give frequently. But the advice that is not so frequently dispensed?

At the same time you review your credit report, you should also sit down with all your bills, set up auto pay for as many of them as you can, and automate your monthly financial obligations as much as possible.

Why?

One of the “big three” factors that helps determine whether your home loan is approved or denied? Your record of on-time payments in the last year or more. If you have late or missed payments, you seriously risk the ability to get your loan approved (depending on circumstances and whether or not the missed payments were an anomaly or not).

Another trick you should try when preparing for your loan and reviewing your credit? You may read a lot of advice regarding credit monitoring; subscribing to a credit monitoring service can help you avoid running into problems due to undetected identity theft.

Did you know that some credit monitoring may include automated fraud alerts to detect activity on your credit report that may not be authorized? Using a fraud alert can be a big help if you are worried about identity theft issues complicating your mortgage.

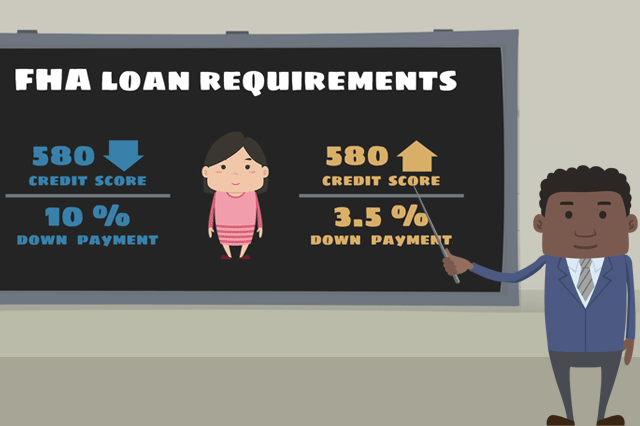

Remember that credit scores affect the interest rate your lender will offer you, they can play a role in determining your down payment, and the earlier you work on your credit the better prepared you will be. On-time payments, stopping identity theft in its tracks, and another tactic--reducing your credit card balances well below 50%--are all important factors in fixing or improving credit ahead of a major loan application.

It’s also important for first-time borrowers to know that if you start preparing for your loan and you find problems in your credit report, you will need plenty of time to correct them. Avoid coming to the loan process with open disputes or problems related to your credit report--lender standards will vary but the loan officer may have a much harder time justifying the approval of your mortgage loan in such cases.

------------------------------

RELATED VIDEOS:

Here's the Scoop on Conventional Loans

When Do You Need a Cosigner?

Analyzing Your Debt Ratio

Do you know what's on your credit report?

Learn what your score means.