Monitoring Your Credit Before Your Home Loan

One important reason is that if an error or evidence of identity theft shows up in your credit report, you can catch it early and begin disputing that information right away. It takes time to dispute and resolve disputes on your credit report--more time than many realize. Catching these problems early helps you to be fully prepared for your loan application later.

Another reason? Credit monitoring is a more active form of protection than simply pulling copies of your credit report at some point and having a look.

Monitoring offers you the means to be fully informed (depending on the level of updates you choose and other variables) and updated in ways that help you make your financial plans without having to wonder what the state of your credit is at a given moment.

A related issue has to do with the accuracy of your reports outside of fraud--it’s common to have credit report entries for a different person with your full name. When reviewing your credit report, do you see old home addresses you do not recognize? Or credit accounts that are not in your name, but are in the name of someone with a first and/or last name similar to yours?

These mistakes can happen at any time and if the person your account is confused with hasn’t been paying THEIR bills? You can see where this is going.

Monitoring your credit for a full year ahead of applying for your home loan could be a very good idea--after all, house hunters are advised to begin planning and saving as early as a year or more from application time--your credit monitoring efforts should start this early, too. You will get a very good idea of the ebb and flow of credit monitoring and how such monitoring affects your choices as a consumer.

Some companies that offer credit monitoring services may also offer financial counseling or home buying advice--it’s never a bad idea to learn more about these areas, too. Especially from companies that have a history of monitoring credit and can advise consumers about common issues related to credit, improving credit scores, and becoming a better credit risk.

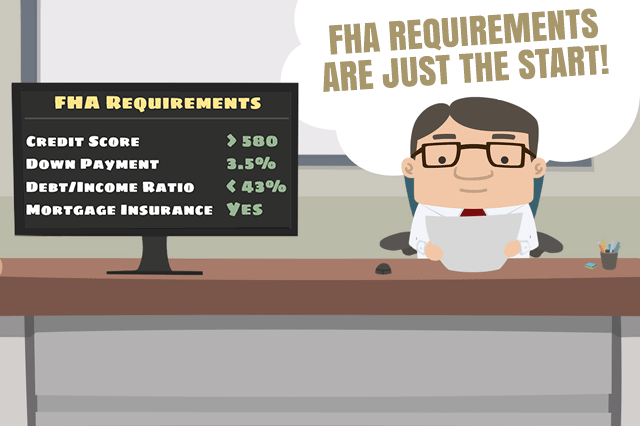

Learn all you can about how credit issues affect your ability to borrow--there are some very simple concepts that inform and drive good credit. Once you understand how these processes work you will be far better prepared to apply for an FHA home loan, refinance loan, One-Time Close construction loan, etc.

------------------------------

RELATED VIDEOS:

There's a Difference Between APR and Interest Rates

Choose Your Mortgage Lender Carefully

Getting Started With Your FHA Loan Application

Do you know what's on your credit report?

Learn what your score means.