One-Time Close Construction Loans for Veterans

Add to that the lack of a mortgage insurance requirement, and the fact that veterans who receive or are eligible to receive VA compensation for service connected medical issues are exempt from having to pay the VA loan funding fee.

But there are some cases where a veteran might choose not to use VA loan entitlement to apply for the construction loan.

That may be simply because the entitlement is not available, or that the veteran wants to save the entitlement for later. A borrower who has purchased a home with a VA loan before would be required to fully pay off the mortgage loan in order to have full VA loan entitlement restored.

The veteran could use partial entitlement, but may be required to discuss the non-VA portion of the loan with the lender as that financial institution may have procedures which must be observed in such cases depending on whether you buy alone or with a co-borrower.

FHA One-Time Close construction loans are also open to those who could otherwise apply with a VA mortgage; the difference between the two construction loan programs is, on a very general level, includes a required down payment for the FHA version of the loan.

However, the down payment is a low 3.5% (at its’ lowest), which is the same as for any other FHA home loan. And that is the beauty of the FHA One-Time Close construction loan; you can be a first-time home buyer, or an experienced homeowner and still be able to apply for the FHA One-Time Close loan.

Your down payment requirements will depend on your FICO scores; those who have scored below 580 must, according to FHA loan rules, make a down payment of 10%. Lender FICO score requirements will also apply and these may be more strict than the FHA minimum standards.

FHA loan rules require occupancy for One-Time Close mortgages, but military members who cannot occupy the home due to active duty requirements are still eligible for maximum financing, “...if a Family Member of the Borrower will occupy the subject Property as their Principal Residence, or the Borrower intends to occupy the subject Property upon discharge from military service” according to HUD 4000.1.

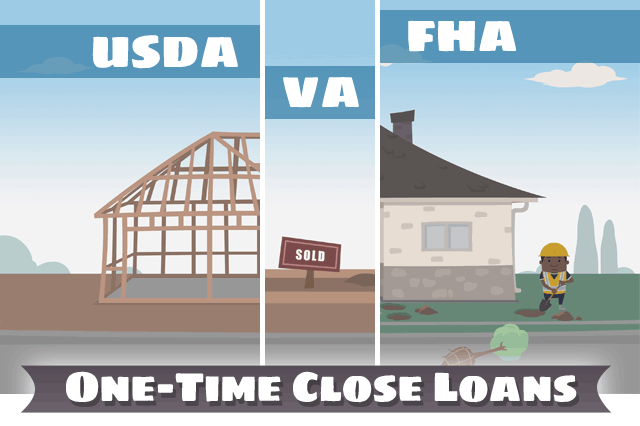

FHA, VA, and USDA: One-Time Close Loans

FHA, VA, and USDA: One-Time Close LoansWant More Information About One-Time Close Loans?

We have done extensive research on the FHA (Federal Housing Administration), the VA (Department of Veterans Affairs) and the USDA (United States Department of Agriculture) One-Time Close Construction loan programs. We have spoken directly to licensed lenders that originate these residential loan types in most states and each company has supplied us the guidelines for their products. We can connect you with mortgage loan officers who work for lenders that know the product well and have consistently provided quality service. If you are interested in being contacted by a licensed lender in your area, please send responses to the questions below. All information is treated confidentially.

FHA.com provides information and connects consumers to qualified One-Time Close lenders in an effort to raise awareness about this loan product and to help consumers receive higher quality service. We are not paid for endorsing or recommending the lenders or loan originators and do not otherwise benefit from doing so. Consumers should shop for mortgage services and compare their options before agreeing to proceed.

Please note that investor guidelines for the FHA, VA, and USDA One-Time Close Construction Program only allow

Your email to [email protected] authorizes FHA.com to share your personal information with a mortgage lender licensed in your area to contact you.

- Send your first and last name, e-mail address, and contact telephone number.

- Tell us the city and state of the proposed property.

- Tell us your and/or the Co-borrower’s credit profile: Excellent – (680+), Good - (640-679), Fair – (620-639) or Poor- (Below 620). 620 is the minimum qualifying credit score for this product.

- Are you or your spouse (Co-borrower) eligible veterans? If either of you are eligible veterans, down payments as low as $0 may be available up to the maximum amount your debt-to-income ratio per VA will allow – there are no maximum loan amounts as per VA guidelines. Most lenders will go up to $750,000 and review higher loan amounts on a case by case basis. If not, the FHA down payment is 3.5% up to the maximum FHA lending limit for your county.

Do you know what's on your credit report?

Learn what your score means.