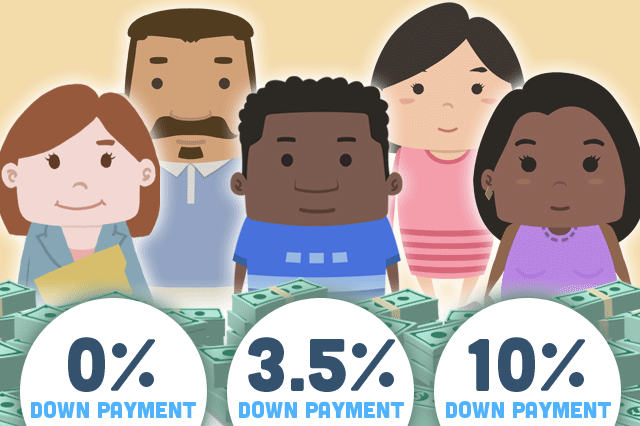

Who Offers the Lowest Down Payment Option?

Borrowers who take the right amount of time to work on credit scores, loan repayment history, and reduced debt-to-income ratios ahead of contacting a real estate agent and a lender get the benefit of improved FICO scores, which makes your lender more inclined to offer terms more competitive than those offered to other applicants.

But aside from that, who gets the lowest down payments on their real estate loans for single-family residences? Remember, for this article we are talking about home loans for those who intend to be owner/occupiers and not about investment properties.

Lowest Down Payment: 0%

Two home loan programs offer zero down or no-money-down home loans. Those programs are backed by the federal government. One is the VA home loan program, which is only available to qualifying service members, veterans, and certain surviving spouses of veterans who have died.

The other program offering a no money down mortgage is from the USDA, and is a need-based home loan. Applicants are required to meet certain financial need criteria and there is an income cap on USDA home loans.

Neither the USDA or the VA mortgage offers the zero down home loan option to the general public; only those meeting the program’s qualifying criteria (being a veteran, having a financial need or hardship, etc.) can get loan approval.

Low Down Payment: 3.5% of the Home's Adjusted Value

FHA mortgages offer the low down payment of 3.5% to borrowers who qualify with FICO scores that fall within the FHA loan program range of acceptable credit scores (580 or higher). To qualify for the 3.5% down, FHA loan applicants must also meet any lender requirements for FICO scores and other credit qualifications.

FHA Loans That Require a 10% Down Payment

The FHA loan program has a credit score range (between 500 and 579) that lenders can use when the borrower doesn’t have ideal credit but still has credit scores that make it possible to justify the loan as a good credit risk.

Borrowers with FICO scores between 500 and 579 technically qualify for an FHA mortgage with a 10% down payment. Additional lender standards may apply, so it’s best to ask a loan officer what is possible in these cases, depending on the borrower’s individual credit history.

------------------------------

RELATED VIDEOS:

Disclosures Give Transparency to Borrowers

Understanding the Purpose of Your Mortgage Down Payment

Putting Money Into Your Escrow Account

Do you know what's on your credit report?

Learn what your score means.