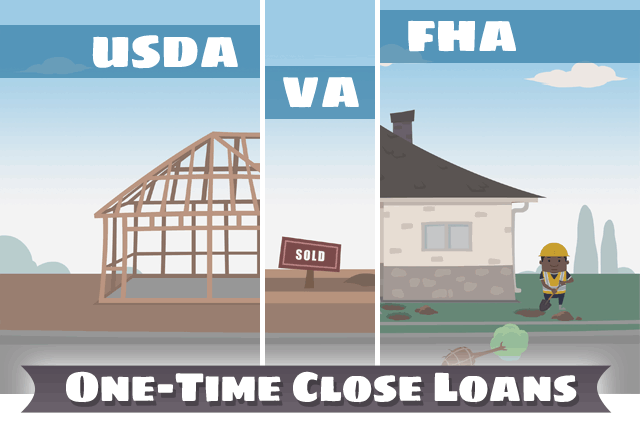

One-Time Close Loans: USDA, VA, and FHA

The Department of Veterans Affairs, The USDA, and the Federal Housing Administration all offer a version of this with aspects that may be unique to each one; for example, VA One-Time Close construction loans feature no VA-required down payment (like other VA home loans) for qualified borrowers.

USDA One-Time Close construction loans may allow borrowers to finance certain closing costs that aren’t allowed with other types of loans, and FHA One-Time Close construction loans may permit third parties to pay some of the borrower’s closing costs (but these contributions are not considered part of the required down payment.

The One-Time Close loan is advantageous, regardless of whether it’s VA, USDA, or FHA, because it combines two loan applications into a single procedure, approval, and closing date.

With OTC, borrowers do not have to worry that the loan for the construction phase will be approved but the second loan (used in non-One-Time Close construction loans) might experience trouble down the line. There is a single closing date that protects the borrower from potential loan denial for the second loan (the mortgage itself) that would occur if the borrower was not approved for One-Time Close.

What do all three of these versions of the One-Time Close Construction Loan have in common?

- Lender standards will apply above and beyond One-Time Close loan minimum requirements from the VA, FHA, or USDA. Lender requirements may factor into your credit score minimum requirements, loan repayment history, interest rates, etc.

- There are restrictions on the type of property you may build with a One-Time Close construction loan guaranteed by FHA, VA, or USDA. Additional lender restrictions may apply. Some lenders do not allow manufactured, mobile home, or modular home projects.

- FICO score requirements may, depending on the lender, be higher for construction loans in general.

- Those who are approved for One-Time Close construction loans are approved to construct owner-occupied residences only.

- One-Time Close loans cannot result in excess cash back to the borrower aside from legitimate refunds.

- Escrow is required to pay contractors, purchase materials, etc. Lender requirements for escrow, state law, and federal regulations will determine how your escrow account is set up and handled. Depending on the phase of your loan, remaining unused funds in escrow may ultimately result in a reduction in loan principal rather than as cash back to the borrower in some form. Borrower should not expect cash back from escrow (as mentioned above).

- There may be restrictions, depending on the lender, for how many living units your property may have.

FHA, VA, and USDA: One-Time Close Loans

FHA, VA, and USDA: One-Time Close LoansWant More Information About One-Time Close Loans?

We have done extensive research on the FHA (Federal Housing Administration), the VA (Department of Veterans Affairs) and the USDA (United States Department of Agriculture) One-Time Close Construction loan programs. We have spoken directly to licensed lenders that originate these residential loan types in most states and each company has supplied us the guidelines for their products. We can connect you with mortgage loan officers who work for lenders that know the product well and have consistently provided quality service. If you are interested in being contacted by a licensed lender in your area, please send responses to the questions below. All information is treated confidentially.

FHA.com provides information and connects consumers to qualified One-Time Close lenders in an effort to raise awareness about this loan product and to help consumers receive higher quality service. We are not paid for endorsing or recommending the lenders or loan originators and do not otherwise benefit from doing so. Consumers should shop for mortgage services and compare their options before agreeing to proceed.

Please note that investor guidelines for the FHA, VA, and USDA One-Time Close Construction Program only allow

Your email to [email protected] authorizes FHA.com to share your personal information with a mortgage lender licensed in your area to contact you.

- Send your first and last name, e-mail address, and contact telephone number.

- Tell us the city and state of the proposed property.

- Tell us your and/or the Co-borrower’s credit profile: Excellent – (680+), Good - (640-679), Fair – (620-639) or Poor- (Below 620). 620 is the minimum qualifying credit score for this product.

- Are you or your spouse (Co-borrower) eligible veterans? If either of you are eligible veterans, down payments as low as $0 may be available up to the maximum amount your debt-to-income ratio per VA will allow – there are no maximum loan amounts as per VA guidelines. Most lenders will go up to $750,000 and review higher loan amounts on a case by case basis. If not, the FHA down payment is 3.5% up to the maximum FHA lending limit for your county.

Do you know what's on your credit report?

Learn what your score means.