FHA Requirements

Debt-to-Income Ratio Guidelines

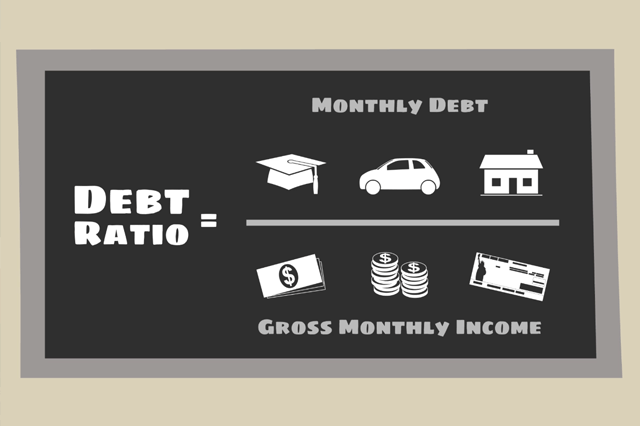

In order to prevent homebuyers from getting into a home they cannot afford, FHA requirements and guidelines have been set in place requiring borrowers and/or their spouse to qualify according to set debt to income ratios. These ratios are used to calculate whether or not the potential borrower is in a financial position that would allow them to meet the demands that are often included in owning a home.

The two ratios are as follows:

1) Mortgage Payment Expense to Effective Income

Add up the total mortgage payment (principal and interest, escrow deposits for taxes, hazard insurance, mortgage insurance premium, homeowners' dues, etc.). Then, take that amount and divide it by the gross monthly income. The maximum ratio to qualify is 31%.

See the following example:

2) Total Fixed Payment to Effective Income

Add up the total mortgage payment (principal and interest, escrow deposits for taxes, hazard insurance, mortgage insurance premium, homeowners' dues, etc.) and all recurring monthly revolving and installment debt (car loans, personal loans, student loans, credit cards, etc.). Then, take that amount and divide it by the gross monthly income. The maximum ratio to qualify is 43%.

See the following example:

Please note that the above indicators do not exclusively determine whether or not a candidate will qualify for an FHA loan. Other factors will be considered, including credit history and job stability.

FHA Loan Requirements

SEE YOUR CREDIT SCORES From All 3 Bureaus

Do you know what's on your credit report?

Learn what your score means.

FHA Loan Articles and Mortgage News

April 14, 2024 - When a first-time homebuyer starts researching their options for a mortgage loan, it’s easy to find bad information and half-true information online, even from otherwise trusted sources. Some publications do their due diligence and review FHA loan rules to ensure accuracy.

April 12, 2024 - There are important choices to make when deciding whether to rent or own, but making the most informed choice is crucial. Some don’t think about the advantage of a fixed mortgage payment over rent that potentially increases year to year.

April 11, 2024 - FHA home loans offer borrowers more forgiving credit qualifying requirements than some conventional mortgages, but borrowers must still qualify for the loan with FICO scores and credit history information. What can you do to improve your credit scores before applying for a loan?

April 10, 2024 - When CBS News reported that the National Association of Realtors agreed to pay $418 million over roughly four years to resolve all claims against the group by home sellers related to broker commissions, the news sent shockwaves through the real estate industry.

April 9, 2024 - If you have never bought or built a home before, it would be easy to assume there is just one type of loan offered and that it’s just a matter of picking a condo, existing construction, new construction, or deciding to build on your own land.