FHA Adjustable Rate Mortgages

ARMs Help Homeowners When Rates are High

The FHA ARM is a HUD mortgage specifically designed for low and moderate-income families who are trying to make the transition into home ownership. This program, used in conjunction with other FHA programs, can help keep initial interest rates and mortgage payments to a minimum. Also referred to as Section 251, FHA's Adjustable Rate Mortgage Program insures home purchases or loan refinances on loans with interest rates that may increase or decrease over time.

How it Works

Through this and other types of mortgage insurance programs, the lender helps low and moderate-income families purchase homes by keeping the initial costs down. By serving as an umbrella under which lenders have the confidence to extend loans to those who may not meet conventional loan requirements, FHA's mortgage insurance allows individuals to qualify who may have been previously denied for a home loan by conventional underwriting guidelines. It also protects lenders against loan default on mortgages for properties that include manufactured homes, single-family and multifamily properties, and some health-related facilities.

Available Assistance

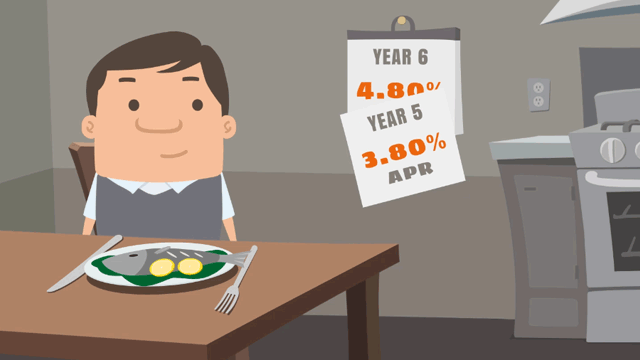

FHA's most popular home loan is the Fixed-Rate 203(b) loan but there are also many other programs available based on the 203(b) that have additional features. One of these is the Section 251 Adjustable Rate Mortgage program which provides insurance for Adjustable Rate Mortgages. When interest rates are high, Adjustable Rate Mortgages keep the initial interest rate on a mortgage low which allows borrowers to qualify for the financing they need.

The beauty of the Section 251 program is that it goes hand-in-hand with other widely used FHA single family products such as:

- Mortgage Insurance for One to Four Family Homes (Section 203(b))

- Single-Family Rehabilitation Mortgage Insurance (Section 203(k))

- Single-Family Mortgage Insurance for Condominium Units (Section 234(c))

While the Section 251 program helps to keep mortgage interest rates and payments low they may change over the life of the loan. The maximum amount of fluctuation in your interest rate in any given year cannot exceed 1 percentage point. And over the life of your loan, the interest rate cannot increase more than 5 percent from your initial rate.

The terms of the Adjustable Rate Mortgage will be disclosed when you apply for your mortgage loan. And should your interest rate increase, you will be informed at least 25 days before any changes are made to your total monthly payment. As an additional benefit of the Section 251 program, if you ever consider refinancing your Adjustable Rate Mortgage you can easily streamline refinance to a Fixed Rate Mortgage at any time.

Aside from the adjustable rate aspect of the Section 251 loan it is very similar to a FHA insured single family loan. Because FHA insurance allows borrowers to finance up to 96.5 percent of the value of their home through their mortgage, down payments can be as little as 3.5 percent of the total value of the home.

FHA allows for many of the closing costs involved in purchasing a home to be financed and the same rules apply for an Adjustable Rate Mortgage loan. The Section 251 program also helps to reduce the initial expenses that are involved in purchasing a home by allowing you to finance many of these charges or roll them into the cost of the mortgage.

The costs you, as the potential homeowner, are responsible for are the down payment, appraisal and title search, any up front charges associated with your mortgage insurance premium which may also be financed, and the subsequent monthly premiums that are added into your mortgage payment.

To better serve you, FHA has set rules in place that limit the amount lenders can charge in making a loan. FHA ensures that the loan origination fees charged by the lender does not exceed one percent of the amount of your mortgage minus the mortgage insurance premium, if it is being financed. As FHA's goal is to best serve low and moderate-income people, they also set limits on the total dollar value of the mortgage loan. View the current established FHA loan limits. Please keep in mind that these figures vary over time and by place, depending on the cost of living and other factors. Higher mortgage limits also exist for two to four family properties.

Application

Any person who is able to meet the cash investment, credit requirements, and mortgage payment is eligible to apply however the program is limited to owner occupants.

Eligibility

All persons intending to occupy the property as their principal residence are eligible to apply. All FHA-approved lenders are qualified to make Adjustable Rate Mortgages and creditworthy applicants may qualify for such loans.

FHA Loan Programs

SEE YOUR CREDIT SCORES From All 3 Bureaus

Do you know what's on your credit report?

Learn what your score means.

FHA Loan Articles and Mortgage News

July 20, 2024 - When you close an FHA mortgage, you make your down payment and pay closing costs, accept the keys to the home, and prepare to move in. But what should you expect after moving into the new house?

July 19, 2024 - There are many FHA home loan programs, including construction loans and reverse mortgages, which have details some borrowers find confusing. However, assistance is available. HUD-approved housing counseling can greatly help.

July 17, 2024 - What fees and expenses can you expect from an FHA reverse mortgage, also known as an FHA home equity conversion mortgage (HECM)? There are a number of important costs to save for. We examine them in this article.

July 16, 2024 - There are many options to consider when planning your home loan. One good example? Some borrowers wonder if they should choose a 15-year FHA loan over a 30-year mortgage. Those who want to save as much money might consider the 15-year FHA loan, but there are other choices.

July 13, 2024 - According to HUD, the changes announced in early July 2024 modernize the program and enhance its usefulness for individuals and families seeking affordable financing for renovating or rehabilitating a single-family home when purchasing or refinancing it.