FHA Requirements

Debt-to-Income Ratio Guidelines

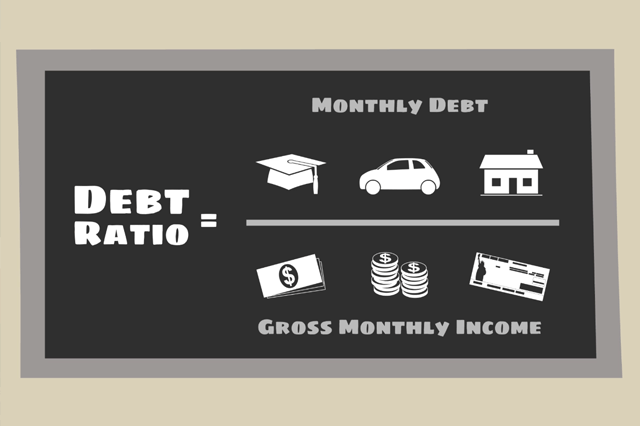

In order to prevent homebuyers from getting into a home they cannot afford, FHA requirements and guidelines have been set in place requiring borrowers and/or their spouse to qualify according to set debt to income ratios. These ratios are used to calculate whether or not the potential borrower is in a financial position that would allow them to meet the demands that are often included in owning a home.

The two ratios are as follows:

1) Mortgage Payment Expense to Effective Income

Add up the total mortgage payment (principal and interest, escrow deposits for taxes, hazard insurance, mortgage insurance premium, homeowners' dues, etc.). Then, take that amount and divide it by the gross monthly income. The maximum ratio to qualify is 31%.

See the following example:

2) Total Fixed Payment to Effective Income

Add up the total mortgage payment (principal and interest, escrow deposits for taxes, hazard insurance, mortgage insurance premium, homeowners' dues, etc.) and all recurring monthly revolving and installment debt (car loans, personal loans, student loans, credit cards, etc.). Then, take that amount and divide it by the gross monthly income. The maximum ratio to qualify is 43%.

See the following example:

Please note that the above indicators do not exclusively determine whether or not a candidate will qualify for an FHA loan. Other factors will be considered, including credit history and job stability.

FHA Loan Requirements

SEE YOUR CREDIT SCORES From All 3 Bureaus

Do you know what's on your credit report?

Learn what your score means.

FHA Loan Articles and Mortgage News

April 24, 2024 - Finding or building your dream home means paying attention to many important details. Is the house you want large enough to live in for 5 to 10 years without outgrowing it? Is your house close enough to essential services like child care or school?

April 21, 2024 - Are home loans riskier in 2024 due to elevated potential for scams and fraud? Fraud prevention company Funding Shield reports high fraud vulnerability in roughly half of all portfolio loans, including residential mortgages, in the first three months of 2024.

April 19, 2024 - We write about many details of FHA home loans, and if you are on the path to homeownership for the first time, it helps to know some of the facts and fiction surrounding these home loans before you start looking for a home, a lender, or applying for pre-qualification.

April 17, 2024 - There is plenty of bad information about home loans in general and FHA loans specifically. You may encounter some of these in the wild when searching for a lender and a home to buy with an FHA mortgage.

April 16, 2024 - Home loans have many similar features. They require down payments, have appraisal standards, and may have rules on how you can use the property you buy. How do home loans compare to one another? We examine some of the major issues in this article.