FHA Loan Programs

Choose from Several 2024 FHA Mortgage Options

With its low down payment requirements and flexible guidelines, FHA-insured loans have always been a great option for first-time homebuyers. This holds true for repeat homebuyers as well. Whether you are buying your first home or moving to a new one, there is an FHA loan program to suit your needs.

FHA Loan Prequalification

Getting prequalified is a simple and quick process, and can even be done over the phone. Your loan officer will require information about your basic finances, such as debt, income, and assets. After running these numbers and evaluating them, he/she can tell you an amount you may qualify to borrow.

While prequalifying for a loan doesn't necessarily guarantee that you will be able to purchase the home of your dreams, it does help you and potential lenders know your borrowing power and what you can afford in terms of a monthly mortgage payment.

- First-Time Homebuyers Can Get Prequalified

- What's Needed From Your FHA Loan Applications?

- Prequalify for an FHA Mortgage Is the First Step

Fixed Rate FHA Loan

A mortgage where the interest rate remains the same through the term of the loan and fully amortizes is known as a fixed rate mortgage. Since the interest rate remains constant, monthly payments don’t change. Fixed rate mortgages come with terms of 15 or 30 years.

Even if mortgage rates increase astronomically, your interest rate is locked in and your monthly payments won’t change. But timing can be your worst enemy when it comes to locking in your rate. You may feel you’re getting a low rate at closing time, but a few months down the line the rates may drop further.

- How Many Types of FHA Refinance Loans Are There?

- Questions to Ask About Your FHA Home Loan

- What You Can and Cannot Do With an FHA Mortgage

Adjustable Rate Mortgage (ARM)

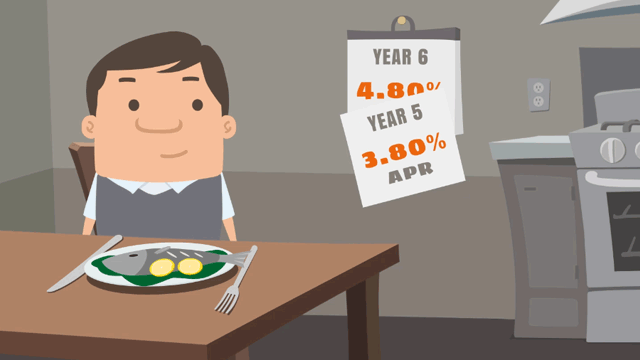

The initial interest rate of the ARM will likely be lower than many fixed rate mortgages, but this only lasts for a certain amount of time. After this introductory fixed-rate period, your monthly payments will increase or decrease according to the interest rate which is tied to an adjustment index.

Adjustable rate mortgages come with “caps” and “ceilings” that put limits on the increase of interest rates over the life of the loan. These help prevent your monthly payments from getting too high, and help look past the uncertainty that comes with ARMs.

SEE YOUR CREDIT SCORES From All 3 Bureaus

Do you know what's on your credit report?

Learn what your score means.

- Should First-Time Homebuyers Consider Adjustable Rate Mortgages?

- FHA Adjustable Rate Mortgage vs. a 15-Year Loan

- FHA Loans: ARM Questions and Answers

FHA Jumbo Loan

Fannie Mae and Freddie Mac have limits on the size of government-backed mortgages, but when a loan exceeds that limit it is known as a jumbo loan. These mortgages are too expensive to for Fannie and Freddie to buy, which is why the limits are placed.

The downside to jumbo loans is that even though the application process has been simplified, they’re not easy to qualify for. As a borrower, you need to have an almost excellent credit score, make a large down payment, and have a low debt-to-income ratio.

- Can I Get Cash Back on an FHA Jumbo Loan?

- What Should I Know About Jumbo Loans?

- What Makes a Jumbo Loan Jumbo?

FHA Condominium Loans

FHA condominium loans can be more complicated than some other types of new purchase real estate loans due to the FHA has requirements places on condo projects. These factors shouldn't discourage a borrower from exploring their FHA condo loan options, but it's important to be aware of the rules in order to save time and begin the search for a new home in the right place.

- FHA Loan Options: Condos and Mobile Homes

- Shopping Around for an FHA Condo Loan

- Four FHA Home Loan Tips for Buying a Condo

Energy Efficient Mortgage

The Energy Efficient Mortgage Loan program helps current or potential homeowners significantly lower their monthly utility bills by enabling them to incorporate the cost of adding energy efficient improvements into their new home or existing housing.

This FHA program eliminates the need for homeowners who are interested in making their home more energy efficient to take out an additional mortgage loan to cover the cost of the improvements they intend to make to their property. The program is available as part of a FHA insured home purchase or by refinancing your current mortgage loan.

- FHA Energy Efficient Mortgages

- The FHA Home Loan Energy Efficient Mortgage Option

- FHA Energy Efficient Mortgage Finances Your Energy Package

Graduated Payment Mortgage

Graduated Payment Mortgages are FHA loans for homebuyers who currently have low to moderate incomes but expect them to increase substantially over the next 5 to 10 years.

- FHA Loan Applications

- FHA Home Loan Down Payments: How Much?

- FHA Loans and Your Monthly Mortgage Payment

Growing Equity Mortgage

FHA Section 245(a) allows those who currently have a limited income, but expect that their monthly earnings will increase, to purchase a home with the help of a Growing Equity Mortgage in which payments start small and increase gradually over time.

- Five FHA Loan Rules for Down Payments

- Getting a Home Loan Even if You Have Credit Problems

- FHA Loan Rules for Employment

SEE YOUR CREDIT SCORES From All 3 Bureaus

Do you know what's on your credit report?

Learn what your score means.

FHA Loan Articles and Mortgage News

April 24, 2024 - Finding or building your dream home means paying attention to many important details. Is the house you want large enough to live in for 5 to 10 years without outgrowing it? Is your house close enough to essential services like child care or school?

April 21, 2024 - Are home loans riskier in 2024 due to elevated potential for scams and fraud? Fraud prevention company Funding Shield reports high fraud vulnerability in roughly half of all portfolio loans, including residential mortgages, in the first three months of 2024.

April 19, 2024 - We write about many details of FHA home loans, and if you are on the path to homeownership for the first time, it helps to know some of the facts and fiction surrounding these home loans before you start looking for a home, a lender, or applying for pre-qualification.

April 17, 2024 - There is plenty of bad information about home loans in general and FHA loans specifically. You may encounter some of these in the wild when searching for a lender and a home to buy with an FHA mortgage.

April 16, 2024 - Home loans have many similar features. They require down payments, have appraisal standards, and may have rules on how you can use the property you buy. How do home loans compare to one another? We examine some of the major issues in this article.