Housing Outlook Improves in First Quarter

A CNBC report on mortgages in early 2024 notes that there was higher demand in the first quarter of the year, which, depending on the market, can put upward pressure on average house prices.

Did the supply rise to meet demand in Q1? CNBC notes that inventory went up nearly 6% overall. That meant as many as a million houses were for sale at the end of February.

Home Sales Up in Q1?

That same report, published near the end of March 2024, notes that existing home sales increased nearly 10% in a single month (from January to February). What does all this mean to house hunters trying to find a home in the second quarter of 2024?

Sometimes, you may need some additional information to know for sure. For example, the above numbers are calculated using mortgage closing data.

That means some borrowers took full advantage of a mortgage rate drop into the mid-6% range. Since then, rates have crept closer to 7%.

Home Buying Strategy

Some borrowers read the paragraph above and feel they must watch rates carefully daily, hoping to act when rates drop to a level they are comfortable with. But day-to-day trends can’t give you an idea of whether or not those rates will persist in a week, two weeks, or even a month.

Trying to time your commitment to a specific day doesn't make sense when rates dip lower. Why? Because you can’t get an interest rate lock commitment from the lender until you are ready to commit to a specific property you want to buy.

And unless the rate changes you see persist longer than a day or even a week, you likely are viewing the typical ups and downs of mortgage interest, not a defining trend.

The Best Advice

Waiting for rates to drop lower simply isn’t advisable. If you want to watch rates and begin your home loan journey once they have hit an identifiably lower trend, you’ll need to watch rates over a longer term than daily or weekly.

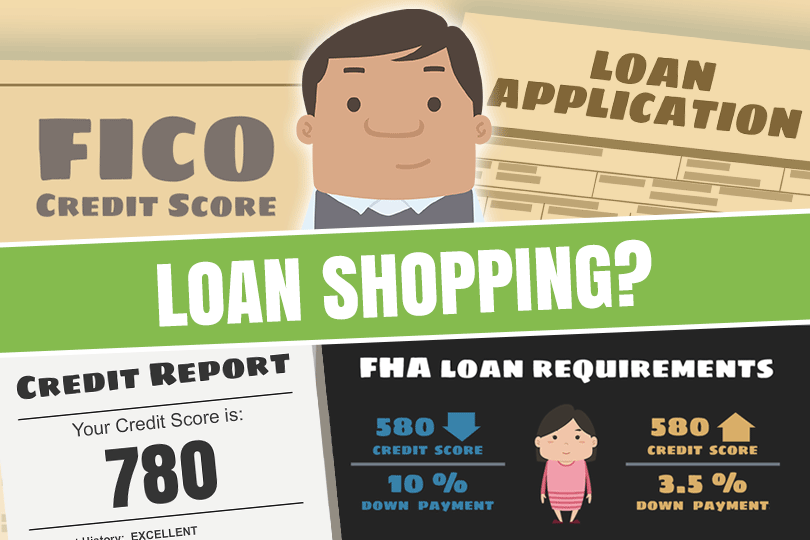

What is the best advice for buying a home when the overall direction of the rates is uncertain? Don’t worry about the rates until you are ready to commit. It’s all speculation until the day you’re ready to “pull the trigger.” There are things you can do to buy down your mortgage rate. You can also work on your credit to get a better FICO score range, contributing to a lower interest rate offer from your participating lender.

------------------------------

RELATED VIDEOS:

Don't Skip the Home Inspection

Bigger is Better With a Jumbo Loan

Insuring Mortgages With the FHA Funding Fee

Do you know what's on your credit report?

Learn what your score means.