Using Escrow for Your FHA Loan

Investopedia defines escrow as an agreement between you and the lender “whereby a third party holds an asset or money on behalf of two other parties that are in the process of completing a transaction.”

This has obvious implications for closing day, but using escrow goes beyond the need to have cash in a protected account to be used only for specific closing day purposes.

Using Escrow When Renovating or Building a Home

Did you know escrow is necessary for any FHA home loan requiring construction or renovation?

That’s because the escrow account is necessary to ensure FHA loan funds go directly from the lender to a contractor or builder doing work on behalf of the borrower. FHA loan funds for purchase, renovation, and construction cannot go directly to the borrower.

Escrow for Energy Efficient Mortgages

Escrow is also necessary in cases where the borrower has applied for an FHA mortgage with an add-on, such as the FHA energy-efficient mortgage package, allowing a borrower to get extra loan funds for approved upgrades to the home. In these cases, the escrow money is used to pay for the energy-saving upgrades.

As with all other types of FHA mortgages in this area, the loan funds can’t pass through the borrower to the contractor. The money must go from escrow directly to the contractor.

Escrow for Property Taxes

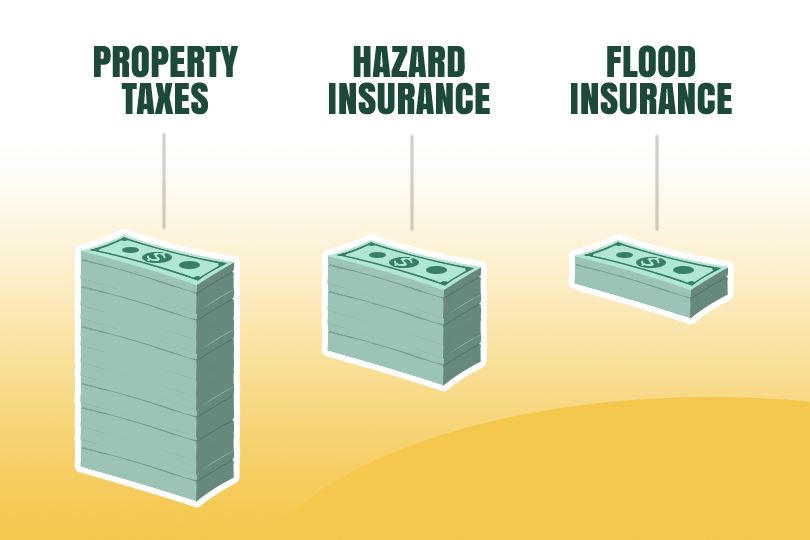

Many borrowers can use escrow to pay their property taxes, but some FHA transactions may require escrow.

Consider the requirements of the FHA reverse mortgage, which allows borrowers to apply for a no-payment mortgage. They can take cash out at closing time, with the loan being due when the borrower dies or sells the home.

One of the conditions of loan approval for FHA reverse mortgages is that the borrower always stays current on property taxes. Using escrow for this is typically required.

Failing to keep up with the property tax obligation is technically a violation of your agreement. The reverse mortgage could be declared due in full if the tax issue is not properly addressed.

Other Uses for Escrow

There are other uses for an escrow account, not just for home loan issues. According to USDA.gov, other types of taxes can be paid from escrow including:

- County

- City

- Township

- School

- Special District

- Supplemental, additional, and corrected tax bills

- Other payments such as water, sewer, and street assessments, where applicable.

RELATED VIDEOS:

Home Equity Can Secure Your Second Mortgage

Consider the Advantages of Discount Points

FHA Limits are Calculated and Updated Annually

Do you know what's on your credit report?

Learn what your score means.