Your FHA Loan Credit Qualifications

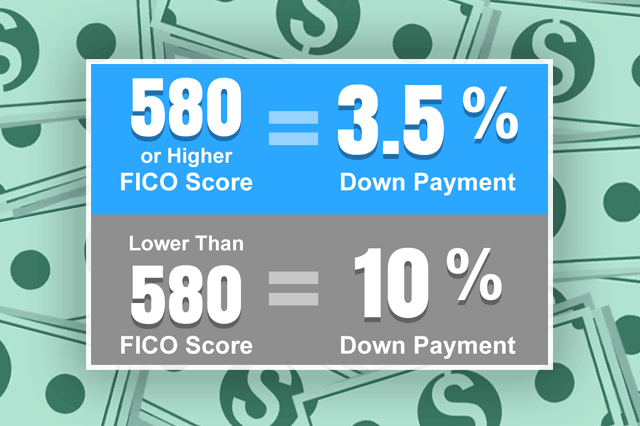

Those FHA FICO score requirements are as follows:

580 or Higher

--------------------

Eligible for maximum financing with a 3.5% minimum down payment

500 to 579

--------------------

Eligible for an FHA mortgage loan with a 10% minimum down payment

Borrowers should know that these FHA minimum FICO score requirements for FHA mortgages do not include any lender standards. You will need to speak with your participating FHA loan officer to see if higher FICO score requirements apply (they can and often do).

Some FHA loan credit qualifications are more stringent depending on the type of refinance loan or FHA forward mortgage you are applying for. FHA One-Time Close construction loans, for example, may have higher FICO requirements from the lender because of the added risk and expense of the new mortgage.

FHA mortgage loan credit requirements don’t stop with FICO score minimums. Your loan repayment history (especially that within the most recent 12 months) will also be an important factor.

Borrowers should be mindful of the fact that coming to the home loan application process with less than 100% on-time payments for all financial obligations could make it hard for your lender to justify approving your loan.

When there are problems in the application such as repeated missed payments, lower FICO scores, or high debt-to-income ratios, the lender may be able to justify loan approval if you have compensating factors.

The ability to make a larger down payment is one of those factors, but also substantial amounts of liquid or potentially liquid assets such as investments, 401(k)s, Treasury bonds, etc.

Some borrowers have excellent credit qualifications in their recent financial history, but with older financial issues such as bankruptcy, foreclosure, or delinquent taxes. FHA loan rules state that in many cases the existence of these problems does not mean an automatic denial of the loan application.

Much depends on how much time has passed since the negative financial events, and what the borrower has done in the meantime to improve credit and establish a history of reliable payments. For certain issues (bankruptcy and foreclosure) a mandatory waiting time is required before a new loan application may be considered. FHA loan rules aren’t the only ones that will affect transactions in these cases; certain kinds of bankruptcy will require the court’s permission in writing for the borrower to apply for a new home loan. In other cases it may be a simple matter of showing that the problems have been resolved to the satisfaction of the creditors and/or court with written documentation to support that.

If your old credit issues are older than three or four years, a conversation with your loan officer may confirm whether you have anything to be concerned with now or not; if your most recent credit history (a year or more) shows you to be a more reliable credit risk, that will work in your favor for FHA home loan or refinance loan approval.

------------------------------

RELATED VIDEOS:

The ARM is an FHA Adjustable Rate Mortgage

Understanding APR

The Appraisal Fee

Do you know what's on your credit report?

Learn what your score means.