FHA Loan Requirements

Important FHA Guidelines for Borrowers

The FHA, or Federal Housing Administration, provides mortgage insurance on loans made by FHA-approved lenders. FHA insures these loans on single family and multi-family homes in the United States and its territories. It is the largest insurer of residential mortgages in the world, insuring tens of millions of properties since 1934 when it was created.

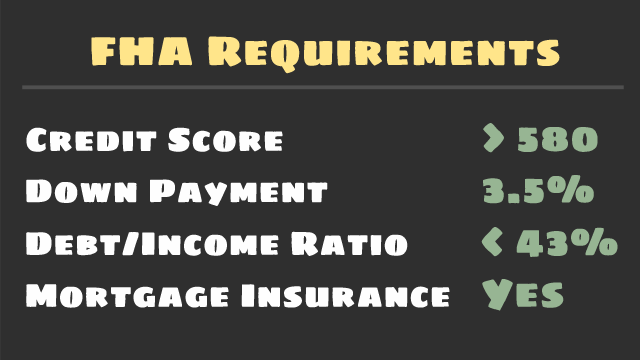

- FICO® score at least 580 = 3.5% down payment.

- FICO® score between 500 and 579 = 10% down payment.

- MIP (Mortgage Insurance Premium ) is required.

- Debt-to-Income Ratio < 43%.

- The home must be the borrower's primary residence.

- Borrower must have steady income and proof of employment.

About FHA Loans

An FHA Loan is a mortgage that's insured by the Federal Housing Administration. They allow borrowers to finance homes with down payments as low as 3.5% and are especially popular with first-time homebuyers.

FHA loans are a good option for first-time homebuyers who may not have saved enough for a large down payment. Even borrowers who have suffered from bankruptcy or foreclosures may qualify for an FHA-backed mortgage.

- Time to Get Started With an FHA Loan

- What Should I Know About Applying for an FHA Mortgage?

- How to Use an FHA Home Loan

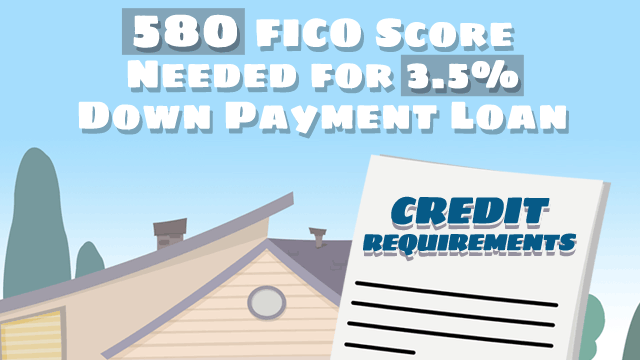

FHA Credit Requirements for 2024

FHA Loan applicants must have a minimum FICO® score of 580 to qualify for the low down payment advantage which is currently at 3.5%. If your credit score is below 580, the down payment requirement is 10%. You can see why it's important that your credit history is in good standing.

Keep in mind that FHA credit requirements cover more than just your FICO® score; they also determine eligibility based on a borrower’s payment history, bankruptcies, foreclosures, and extenuating circumstances that keep applicants from making timely payments.

- The Facts About FHA Credit Requirements and FICO® Scores

- Do FHA Loan Requirements Apply to All Borrowers?

- Your FHA Loan Credit Qualifications

What's a FICO® Score?

The FICO® score is a number that represents a potential borrower's creditworthiness. FICO® is a data analytics company which uses consumer credit files collected from different credit bureaus to compute their scores.

Your FICO® score is reviewed by lenders and is used to determine how likely you are to make timely payments on your mortgage. The higher the score, the better your chances are of getting a lower interest rate on your mortgage.

SEE YOUR CREDIT SCORES From All 3 Bureaus

Do you know what's on your credit report?

Learn what your score means.

- What FICO® Score Do I Need Buy A Home?

- How FICO® Scores Affect Your FHA Home Loan

- FICO Scores and Home Loans: What You Need to Know

FHA Loan Credit Issues

Your FHA lender will review your past credit performance while underwriting your loan. A good track record of timely payments will likely make you eligible for an FHA loan. The following list includes items that can negatively affect your loan eligibility:

- No Credit History

If you don't have an established credit history or don't use traditional credit, your lender must obtain a non-traditional merged credit report or develop a credit history from other means. - Bankruptcy

Bankruptcy does not disqualify a borrower from obtaining an FHA-insured mortgage. For Chapter 7 bankruptcy, at least two years must have elapsed and the borrower has either re-established good credit or chosen not to incur new credit obligations. - Late Payments

It's best to turn in your FHA loan application when you have a solid 12 months of on-time payments for all financial obligations. - Foreclosure

Past foreclosures are not necessarily a roadblock to a new FHA home loan, but it depends on the circumstances. - Collections, Judgements, and Federal Debt

In general, FHA loan rules require the lender to determine that judgments are resolved or paid off prior to or at closing.

- Home Loan Prep: What One Credit Reporting Agency Says

- FHA Loans, Missed Payments, and My Credit Report

- FHA Loan Rules You Should Know About Judgments

Benefits of an FHA Loan

- Easier to Qualify

FHA provides mortgage programs with lower requirements. This makes IT easier for most borrowers to qualify, even those with questionable credit history and low credit scores. - Competitive Interest Rates

FHA loans offer low interest rates to help homeowners afford their monthly housing payments. This is a great benefit when compared to the negative features of subprime mortgages. - Bankruptcy / Foreclosure

Having a bankruptcy or foreclosure in the past few years doesn't mean you can't qualify for an FHA loan. Re-establishing good credit and a solid payment history can help satisfy FHA requirements. - Determining Credit History

There are many ways a lender can assess your credit history, and it includes more than just looking at your credit card activity. Any type of payment such as utility bills, rents, student loans, etc. should all reflect a general pattern of reliability.

- Tired of Renting? The Benefits of an FHA Mortgage

- FHA Loan Advice for Borrowers With Thin Credit

- Qualifying for a New FHA Mortgage With a Past Loan Forbearance

FHA vs. Conventional Loans

After learning about some features of an FHA mortgage, undecided borrowers often choose FHA loans over conventional loans because of lower down payment requirements, better interest rate offerings, and unique refinance opportunities.

- Down Payment Requirements

While FHA loans can be had with as little as 3.5% down, conventional loans usually require a 20% down payment. These funds must come exclusively from FHA-approved sources, such as your savings account, money saved at home, investments you have cashed in, gift funds, etc. - Mortgage Insurance

Conventional loans usually require the borrower to carry Private Mortgage Insurance if borrowers don't provide a minimum 20% down payment. FHA mortgages are different and require the payment of an Up Front Mortgage Insurance Premium and an annual Mortgage Insurance Premium (MIP).

- FHA vs. Conventional Loans: Interest Rates and Payoff Dates

- FHA vs. Conventional Loans: Mortgage Insurance and Refinance Options

- Choose Your Mortgage Options Carefully

Down Payment Assistance in 2024

Down payment assistance programs make the mortgage process more affordable for eligible applicants who are interested in purchasing a home but need financial help to do so. Money is usually provided in the form of a non-repayable grant, a forgivable loan, or a low interest loan. Homebuyer education courses may be required.

Typically, a property being purchased must serve as the applicant’s primary residence and must be located within a specific city, county, or state. It may also need to fall within a program's maximum purchase price limits. Income limits may apply, and will look something like this (these numbers may not match your program's requirements):

- 1 person household: $39,050

- 2 person household: $44,600

- 3 person household: $50,200

- 4 person household: $55,750

- 5 person household: $60,250

- 6 person household: $64,700

- 7 person household: $69,150

- 8 person household: $73,600

Household income is normally defined as all income received by household members (18 years or older) who will be living in the home, even if they are not on the mortgage.

- Down Payment Assistance for FHA Loans

- FHA Loan Down Payment Questions

- FHA Home Loans for Single Parents

Down Payment Gifts

Borrowers wishing to purchase a home with an FHA loan may need some help with the down payment. FHA loan rules not only regulate the source of funds in this way, it also governs who may provide such gifts. Be prepared to provide supporting documentation for the source of any financial gift associated with your home loan transaction. Gifts may be provided by:

- Borrower's family member

- Borrower's employer or labor union

- A close friend with a clearly defined and documented interest in the borrower.

- A charitable organization.

- A governmental agency or public entity with a program providing homeownership assistance to low- or moderate-income families or first-time homebuyers.

- FHA Loan Rules for Down Payment Gift Funds

- Down Payment Gifts: What You Need to Know

- FHA Loan Down Payments and Their Sources

2024 FHA Loan Limits

The FHA has calculated the maximum loan amounts that it will insure for different parts of the country. These are collectively known as the FHA lending limits. These loan limits are calculated and updated annually. They're influenced by type of home, such as single-family or duplex, and location. Some homebuyers choose to purchase homes in counties where lending limits are higher, or may look for homes that fit within the limits of the place they want to live.

| LOW COST AREA | |||

| 2024 FHA Limits | |||

| Single | Duplex | Tri-plex | Four-plex |

|---|---|---|---|

| $420,680 | $538,650 | $651,050 | $809,150 |

| HIGH COST AREA | |||

| 2024 FHA Limits | |||

| Single | Duplex | Tri-plex | Four-plex |

|---|---|---|---|

| $970,800 | $1,243,050 | $1,502,475 | $1,867,275 |

- Do FHA Loans Have Income Limits for Borrowers?

- When Do FHA Loan Limits Change?

- FHA Loan Limits Facts and Calculations

FHA Closing Costs

While FHA requirements define which closing costs are allowable as charges to the borrower, the specific costs and amounts that are deemed reasonable and customary are determined by each local FHA office.

- Lender's origination fee.

- Deposit verification fees.

- Attorney's fees.

- The appraisal fee and any inspection fees.

- Lender's origination fee.

- Cost of title insurance and title examination.

- Document preparation (by a third party).

- Property survey.

- Credit reports (actual costs).

- Transfer stamps, recording fees, and taxes.

- Test and certification fees.

- Home inspection fees up to $200.

- FHA Home Loan Rules for Closing Costs

- When the Seller Wants to Help Pay Your FHA Closing Costs

- Can FHA Closing Costs Be Financed?

FHA Loan Checklist

As the buyer and borrower, you will have items on your checklist that are required by your lender, the seller, and even the title company. The closing checklist covers all the fees to be paid, the information to be provided, and the disclosures to be signed before the title is conveyed to you.

- Identification

All parties at the closing should have valid ID. - Title Insurance Policy

You must pay for title insurance that guarantees the property is free of previous claims or liens. - Homeowner's Insurance Policy

Before you can close on the property, you need to secure homeowner’s insurance, which insures the property in the case of damage. - Closing Funds

You must bring all funds agreed upon, in the form of a cashier’s check or via electronic wire.

- Mortgage Loan Basics for New Borrowerss

- How to Pay Your Closing Costs

- Ways to Improve Your Credit Ahead of Your Home Loan

MIP (Mortgage Insurance Premium)

FHA insured loans require mortgage insurance to protect lenders against losses that result from defaults on home mortgages. Depending on the terms and conditions of your home loan, most FHA loans today will require MIP for either 11 years or the lifetime of the mortgage.

MIP Rates for FHA Loans Over 15 Years

If you take out a typical 30-year mortgage or anything greater than 15 years, your annual mortgage insurance premium will be as follows:

| Base Loan Amount | LTV | Annual MIP |

|---|---|---|

| ≤ $625,500 | ≤ 95% | 80 bps (0.80%) |

| ≤ $625,500 | > 95% | 85 bps (0.85%) |

| >$625,500 | ≤ 95% | 100 bps (1.00%) |

| > $625,500 | > 95% | 105 bps (1.05%) |

Update:FHA Lowers Mortgage Insurance in 2015

Update:Trump Administration Reverses 2017 MIP Reduction

- FHA Loans and Mortgage Insurance Requirements

- FHA vs. Conventional Loans: Mortgage Insurance and Refi Options

- FHA Home Loan Basics: Why You May Need an Escrow Account

Debt Ratio for FHA Loans

In order to protect homebuyers from getting into a home they cannot afford, FHA guidelines have been set in place requiring borrowers and/or their spouse to qualify according to set debt-to-income ratios.

These ratios are used to calculate whether or not the potential borrower is in a financial position that would allow them to meet the demands that are often included in owning a home.

- FHA Loan Debt-to-Income Ratio Requirements

- FHA Mortgage Applications and Debt Ratios

- What are Compensating Factors for FHA Loan Approval?

First-Time Homebuyers

If you're' considering buying your first home, there are a number of FHA Loan and other programs that can assist you with your purchase.

- Individuals and spouses without ownership of a principal residence during the past three years.

- Single parents who have only owned a property with a former spouse while married.

- Individuals who are displaced homemakers and have only owned with a spouse.

- Individuals who have only owned a principal residence not permanently affixed to a permanent foundation in accordance with applicable regulations.

- Individuals who have only owned property that was not in compliance with state, local or model building codes and which cannot be brought into compliance for less than the cost of constructing a permanent structure.