FHA Loan Facts and Fiction: Loan Purposes and Other Issues

But the purpose of your home loan matters, and there’s no single FHA mortgage for all options. You may need to choose a construction loan, a rehabilitation mortgage, or a purchase loan with the option to add energy-saving upgrades to the home. Which loan is right for you?

FHA Loan Fact: You Can Use an FHA Mortgage to Build or Buy

The loan you want for a purchase loan for an existing structure is the FHA 203(b) Single-Family Mortgage. If you need to build a house from the ground up, you’ll need to ask the lender about FHA One-Time Close construction loans.

FHA Loan Fiction: You Can Use an FHA Loan to Buy a Business

FHA loans are for buildings that are “primarily residential” and where the non-residential nature of the property is “subordinate” to the use of the property as a home.

FHA Loan Fact: You Can Rent Unused Living Units in the Home

The caveat here? You must live in the property as your primary residence.

FHA Loan Fiction: Rehab and Construction Loan Funds Are Unregulated

If you use an FHA loan to build or repair a home, you must have your project reviewed and approved by the lender, and the cash for the work is tightly controlled.

You don’t have a blank check with a construction loan or rehab loan as you would if you did the same work with an FHA Cash-Out Refinance.

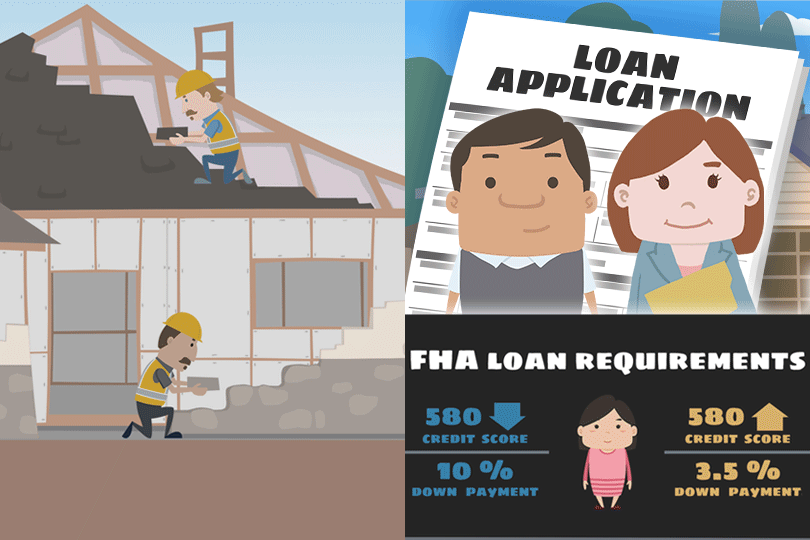

FHA Loan Fact: Down Payment Requirements May Be Lower

When building or renovating a home with an FHA mortgage, you are still subject to the same requirements for a down payment.

You’ll need a minimum of 3.5% down even for a construction loan. You won’t find FHA loan down payment rules forcing you to consider a higher down payment just because you choose a construction loan or rehab loan.

FHA Loan Fiction: Mortgage Insurance Is Avoidable

All FHA mortgages to buy or build a home require mortgage insurance. Depending on the loan term and other variables, your mortgage insurance is payable for 11 years or the entire loan.

FHA Loan Fact: Your Loan Options May Change

If you qualify for an FHA home loan and your lender approves the mortgage, you aren’t “safe” until you close the loan and take the keys, at least when having major changes in your finances, employment, or other factors that went into approving the loan.

Don’t quit your job, start a new career, apply for a car loan, or switch from salary to commission when you are in the middle of a home loan. Those changes could force the lender to re-qualify you for the loan and run your credit again.

------------------------------

RELATED VIDEOS:

Learn How to Meet FHA Requirements

Understanding APR

Your Proof of Ownership Is the Property Title

Do you know what's on your credit report?

Learn what your score means.