FHA Home Loans: What to Expect in 2023

One mortgage industry whitepaper notes that more than 60% of house hunters research homes for sale online, nearly 40% are willing to explore a listed property virtually, and well about 25% of home buyers choose to review their mortgage documents digitally ahead of closing time.

Some are even choosing to have homes virtually inspected instead of hiring a home inspector to physically walk through the property.

These trends are likely to continue in 2023; why try to stay current with them if you are looking for a home to buy in the new year? FHA loan limits are increasing for the third year in a row and many want to know their options for buying or refinancing in the new year.

One important reason to pay attention to these mortgage trends is that sometimes a trend winds up becoming an industry standard. Once upon a time, there was no such thing as a digital signature.

Eventually as that technology began catching on, it became an option for mortgages. Today, many borrowers have the option not just to sign their mortgages digitally but also to have their entire closing done online.

The Freddie Mac official site has a section on its guidelines for electronic closing or “e-closing” a mortgage.

“In an eClosing, most or all of the steps in the closing process take place online, that is, documents are prepared, viewed, signed, stored and transmitted electronically.”

Freddie Mac notes that paper closings and eClosings have “the same parties, legal documentation and need for valid enforceable mortgage loan documents.”

Borrowers who are unfamiliar with digital signatures or electronic closing procedures might want to get an education before they start the loan application process. Applying online, closing online, and even doing inspections online may save a great deal of time in the mortgage loan process.

Some don’t want to embrace new technology. One industry whitepaper notes that only two percent of those in the Baby Boom generation opted in to a virtual inspection. Some “generational resistance” to completing or partially completing a loan transaction digitally should be expected. But if you value speed and efficiency in the process, it may be worth getting to know these options better.

Going into the new year, borrowers should expect to see changes not only in the state of the market itself, but continuing changes in mortgage technology that can make the process more efficient. You don’t have to become an expert in e-signatures or digital loan documents, but it helps to have some basic familiarity with how the process works. This helps you better understand what happens next, but it also protects you against scammers who might otherwise take advantage of your lack of knowledge about industry practices and tech.

------------------------------

RELATED VIDEOS:

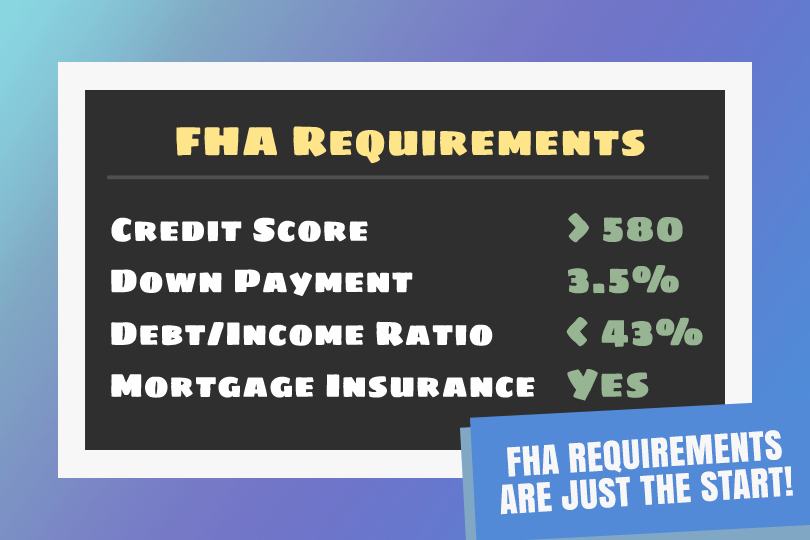

Learn How to Meet FHA Requirements

A Few Tips About Your Fixed Rate Mortgage

Your Proof of Ownership Is the Property Title

Do you know what's on your credit report?

Learn what your score means.