Is There a Bad Credit FHA Loan?

You can work to improve your credit score over time--doing so potentially gives you access to more competitive interest rates, lower down payments, and other perks of improving credit.

Is there such a thing as a bad credit Federal Housing Administration loan that can help people become homeowners in spite of their past credit activity? There are important things you should know about FHA loan approval guidelines.

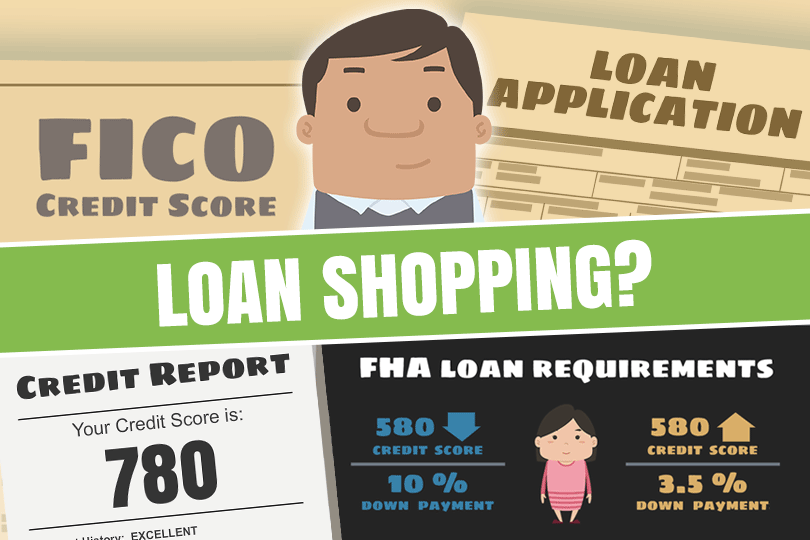

FICO Scores

FHA loan rules, found in HUD 4000.1, say that applicants with FICO scores in the 500 range may technically qualify for an FHA mortgage with 10% down on a purchase loan instead of the lower 3.5% down payment for FICO scores at 580 or higher.

That is the FHA end--what about the lender portion of the transaction? Participating FHA lenders may have higher FICO score requirements which are referred to as lender overlays.

Mortgage lender overlays can include more than just FICO score requirements but for our purposes here the most important thing to know about those overlays is that your FICO scores are viewed differently by different lenders and your experience may vary depending on where you start shopping for a lender.

You can start working on your credit to improve your scores and the best place you can start (other than right this moment) is in the planning stages of your new loan.

Working on Credit

Improve credit by making on-time monthly payments on all financial obligations with no exceptions, and start reducing the balances on your credit accounts well below 50% over time. You won't see the results right away, but as the months go by your credit report will begin to reflect the improvements you make.

First-time home buyers sometimes don't realize that consistency in your credit history is important--try to establish that consistency long before you commit to mortgage payments or a loan program.

When it comes time to apply for a mortgage loan, if you worry that your FICO scores are still too low for the lowest down payment, keep in mind that your ability to provide a higher downpayment is a compensating factor a lender could use to offset lower credit scores.

Another such compensating factor? Your willingness to accept higher mortgage rates. By working on your credit for at least a year in advance, you may be able to improve your scores and avoid a higher mortgage rate.

Housing Counseling Helps

If you are reading this article, why not also get some home buying advice as early as possible while working to improve your credit. Did you know you can get an FHA referral to local housing counselors who give you good advice about how to prepare for a monthly mortgage payment and other issues?

Call the FHA directly at their toll-free number, 1-800-CALL-FHA. Ask them to refer you to your local HUD-approved housing counseling agency.

------------------------------

RELATED VIDEOS:

Let's Talk About Home Equity

Understanding Your Loan Term

Your Home Loan is Called a Mortgage

Do you know what's on your credit report?

Learn what your score means.