FHA Loan Credit Score Facts You Need to Know

The lowest scores in the still-acceptable range may require further development by the lender or you may be asked to provide compensating factors such as a larger down payment or having large cash reserves.

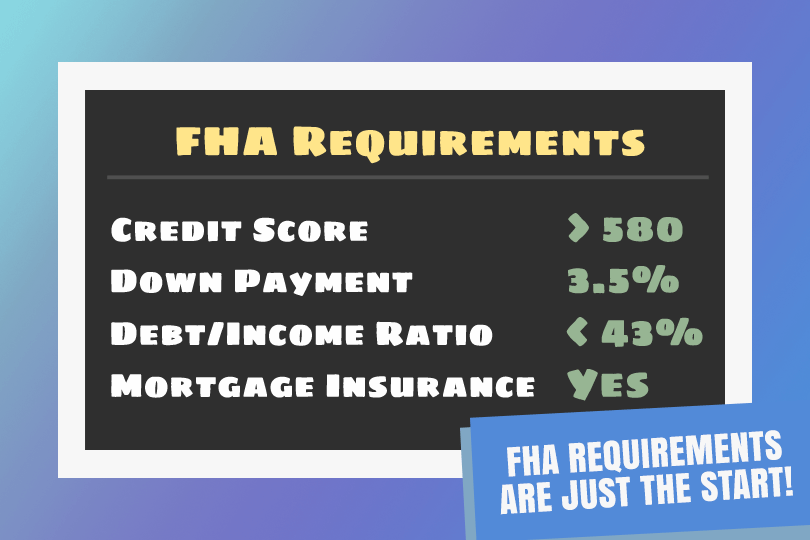

Those minimums? Applicants with a minimum credit score of 580 or higher technically qualify for the lowest down payment.

Borrowers with FICO scores in the 580 range should know that your chosen participating FHA lender may choose not to approve a home loan at the lowest end of this FICO score range for approving FHA mortgages.

Or they may approve the loan but require a higher interest rate. When you want to purchase a home using an FHA loan, both the FHA minimums and the lender's minimums are a factor.

But numbers aren't the only thing used to approve a loan guaranteed by the Federal Housing Administration or even a conventional loan. Your credit history also factors in. How many late payments have you had in the 12 months leading up to your loan application?

Have you missed any mortgage payments in the past? Or if you have been a renter, do your monthly rent and debt payments have a clean record with regard to paying on time?

And what about borrowers who don't have much of a credit history to begin with? Non-traditional credit counts too, but the same rules apply.

Your lender wants to see first time home buyers (and everyone else) coming to the bargaining table with a dependable record of payments, which definitely changes your credit score for the better.

And what about those with thin credit? You will need to follow the on-time payment concept that credit reporting agencies like Equifax, Transunion, and Experian talk about so much, but you may need to apply for a secured credit card or make some effort to build up your credit over time with small credit accounts.

Thin credit and non-traditional credit can be used to approve a loan application but expect the lender to take a harder look at your finances.

You will want to come to this application process as prepared as possible to impress the lender and even if you have to delay your home loan application to get the record of on-time payments and responsible credit use you need, it will be well worth the effort.

------------------------------

RELATED VIDEOS:

Sometimes It Pays to Refinance

Don't Forget Your Closing Checklist

Monthly Payments Establish Good Credit

Do you know what's on your credit report?

Learn what your score means.