Home Loans And FICO Scores

FICO Score Range Basics

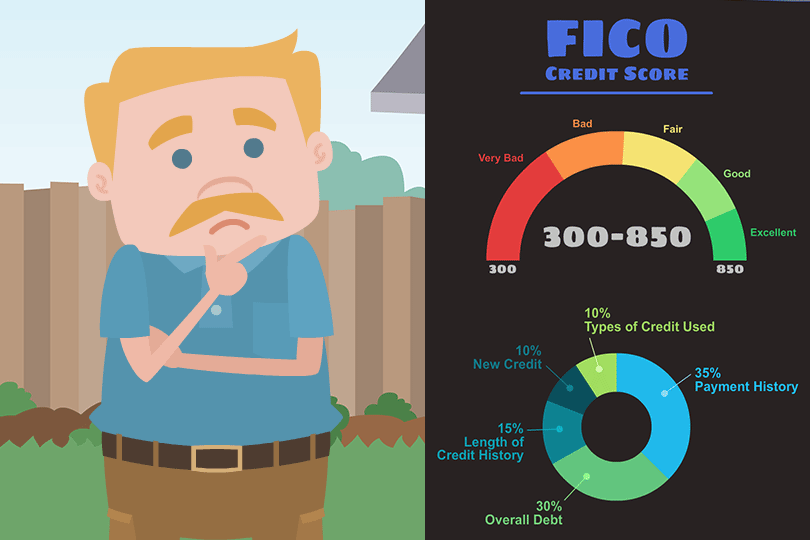

Credit scores basically range between 300 and 850. What makes a “good” credit score? That may depend on what your lender is willing to approve, but in general, FICO scores between 670 and 739 are “good”. Scores above this--740 to 850--are “excellent.”

If your FICO scores range between 580 and 699, you may be technically eligible for a home loan, but it may be harder to get loan approval.

FHA home loans permit loan approval for maximum financing (a 3.5% down payment would be required) for FICO scores at 580 or higher. But the lender’s credit requirements will also be an important factor.

What if My Credit Scores Are Low?

FICO scores play a very important role in loan approval, so it is critical to begin working on your credit as early as possible once you have decided to commit to a home loan. You CAN improve your credit by paying all bills on time every time for at least a year leading up to your mortgage loan application, lowering the balances on your credit cards, and avoiding new lines of credit.

The good news is that lenders don’t just look at credit scores to approve your home loan. The history of your credit use including on-time payments and how low your credit card balances are also factor into loan approval.

Other factors that matter? How long you have been working, how dependable your income is, and whether you’ve had major changes to your income recently.

How to Help Yourself Fix Credit Scores

It is a very good idea to consider investing in credit monitoring while you are planning and saving for your new home loan. Credit monitoring helps you avoid surprises before you apply--if you have issues with identity theft, outdated or inaccurate information on your credit report, etc. a reputable credit monitoring service can help you with early warnings.

It takes time and patience to repair your own credit, and knowing how your lender will view your credit report can be an important factor in getting your mortgage loan approved.

Try to approach your credit thinking like a lender--ask yourself if your credit report looks like one a loan officer would approve of for home loan purposes. And don’t forget that you can always wait a bit longer to apply for your loan if you need extra time to work on your FICO score.

------------------------------

Learn About the Path to Homeownership

Take the guesswork out of buying and owning a home. Once you know where you want to go, we'll get you there in 9 steps.

Step 1: How Much Can You Afford?

Step 2: Know Your Homebuyer Rights

Step 3: Basic Mortgage Terminology

Step 4: Shopping for a Mortgage

Step 5: Shopping for Your Home

Step 6: Making an Offer to the Seller

Step 7: Getting a Home Inspection

Step 8: Homeowner's Insurance

Step 9: What to Expect at Closing

Do you know what's on your credit report?

Learn what your score means.