How Your Credit Score Affects Your Home Loan

How FICO Scores Affect Your Down Payment

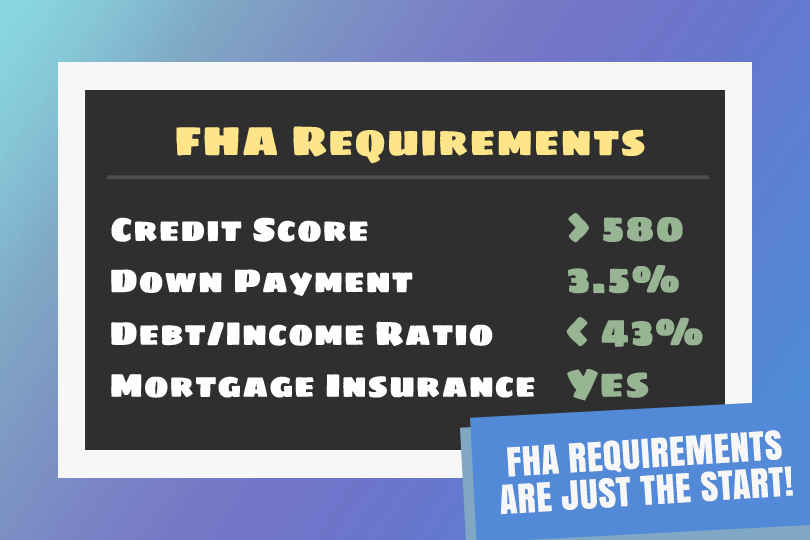

FICO score standards come in two varieties--the FHA minimums and your lender’s standards which may or may not be higher than the FHA minimum. FHA FICO score minimums start at 580 or better for maximum financing and the lowest down payment. FHA loans technically permit borrowers with FICO scores between 500 and 579 to apply for a loan with a higher down payment.

And that’s just one way your credit scores affect your home loan beyond simple approval/denial issues. The lower your credit score is, the closer you may get to having a larger down payment requirements.

Your lender’s credit score standards in this area will be an important part of that equation--be sure to ask about the down payment rules and how your FICO scores may affect how much you’re required to put down.

How FICO Scores Affect the Overall Cost of Your Home Loan

You’ll read many real estate blogs or mortgage lending blogs about how low your FICO scores can be before the lender won’t approve the loan. But what some ignore or gloss over when considering this is the fact that your credit scores can play a role in the interest rate you are offered by the lender. And that will affect the long-term cost of the mortgage.

Remember, you’ll be paying on that interest rate for the lifetime of the loan unless you sell or refinance; a higher mortgage loan interest rate over a 30-year loan term will add up. If your goal is to save money over the loan term, you’ll need to work on your FICO scores to qualify for the lowest rate possible.

You can work on your own credit without paying a third party for so-called credit repair; the key is to make all your payments on time, every time, and cut your debt to income ratio down as much as possible.

Remember that it’s very rare for people to come to the home loan process with perfect credit, but you can work on your own credit scores in the year or more leading up to your loan application and over time your scores will improve.

You can lower the interest rate on your mortgage by purchasing discount points up front, but buying discount points isn’t a good investment if you don’t plan to stay in the home long-term or for the entire loan term. If you know you’ll sell in five or even ten years, discount points may not be the right choice.

------------------------------

RELATED VIDEOS:

Home Equity Can Secure Your Second Mortgage

Consider the Advantages of Discount Points

FHA Limits are Calculated and Updated Annually

Do you know what's on your credit report?

Learn what your score means.