FHA Announces More Mortgage Relief for Borrowers Affected by COVID-19

A press release titled, “FHA Expands Home Retention Measures For Homeowners Financially Impacted By Covid-19” announces the measures, which are meant to help homeowners bring their mortgage up to date at the end of the loan forbearance period.

“Effective immediately,” the press release issued July 8, 2020 states, “mortgage servicers will be able to use an expanded menu of loss mitigation tools” referred to in the lending industry as a “waterfall,” to help determine the homeowners’ eligibility “for other options to bring their mortgages current if they do not qualify for FHA’s COVID-19 National Emergency Standalone Partial Claim.“

Those who aren’t sure whether this applies to them should discuss the option with their loan servicer.

These new measures are offered to FHA borrowers who had loans that were current or no more than 30 days past due as of March 1, 2020. HUD officials have gone on record with their support of FHA borrowers and homeowners.

“Our goal throughout this crisis has been to prevent American homeowners from losing their homes through no fault of their own...” according to the head of the agency.

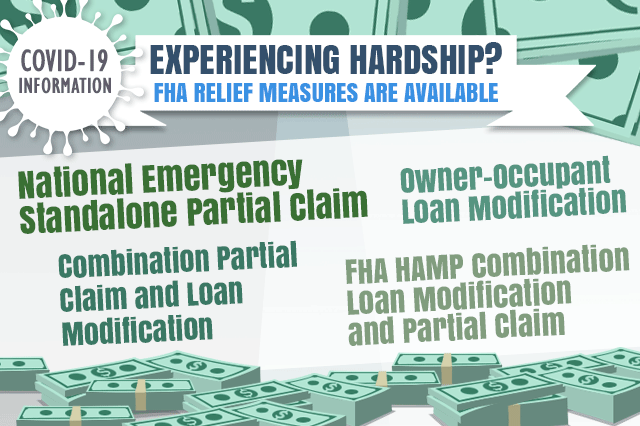

What exactly does the FHA “home retention waterfall” (as it’s referred to in the press release) do for FHA borrowers? It allows the lender to assess the borrower for the following options that could apply after the original loan forbearance period has ended:

COVID-19 National Emergency Standalone Partial Claim, which “takes all past due mortgage amounts and puts them in a separate, junior lien” for as much as 30 percent of the mortgage’s unpaid principal balance. How does this help? The junior lien is “only repayable when the mortgage ends, which, for most borrowers, is when they refinance or sell their home” according to the FHA and HUD.

- COVID-19 National Emergency Standalone Partial Claim, which “takes all past due mortgage amounts and puts them in a separate, junior lien” for as much as 30 percent of the mortgage’s unpaid principal balance. How does this help? The junior lien is “only repayable when the mortgage ends, which, for most borrowers, is when they refinance or sell their home” according to the FHA and HUD.

- COVID-19 Owner-Occupant Loan Modification--an option for those who do not qualify for the above COVID-19 Standalone Partial Claim. This option will alter the rate and term of the existing mortgage.

- COVID-19 Combination Partial Claim and Loan Modification--an option for those who can’t qualify for either one of the above. It uses a partial claim (for up to 30 percent of the unpaid principal balance) with “any other amounts owed” subject to mortgage modification.

- COVID-19 FHA HAMP Combination Loan Modification and Partial Claim--a sort of last resort intended for FHA borrowers “not eligible for any other home retention solution”. There is a reduced documentation requirement and borrowers who need this option should discuss how to proceed with the lender.

These options are for owner-occupiers using the property they purchased with an FHA mortgages; those who don’t occupy the home purchased with the FHA loan as their primary residence will not have access to the options above.

Instead, these borrowers must apply for a COVID-19 Non-Occupant Loan Modification, “which allows non-occupant borrowers who have received COVID-19 forbearance to obtain a modification to their mortgage rate and term.”

------------------------------

RELATED VIDEOS:

Here's the Scoop on Conventional Loans

When Do You Need a Cosigner?

Analyzing Your Debt Ratio

Do you know what's on your credit report?

Learn what your score means.