COVID-19 Update: Credit Requirements Are Getting Tighter

Credit Requirements May Get Tighter

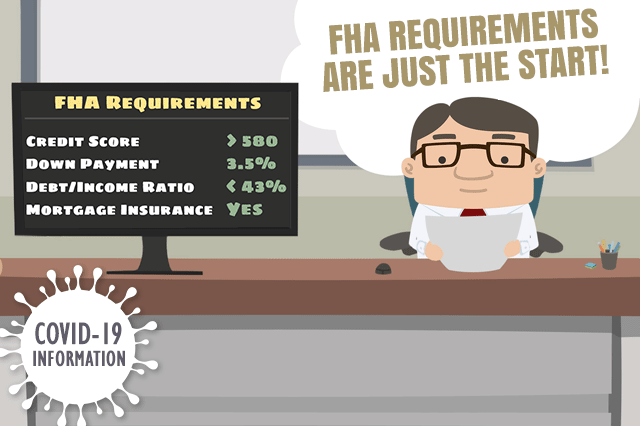

There are millions of homeowners affected by coronavirus lockdown measures, and millions of home loan forbearances. That puts pressure on the mortgage industry and while the FHA itself has NOT changed its credit requirements, participating lenders ARE. This means that borrowers may need to start working on their credit earlier, and longer before applying for a mortgage.

There’s more. The current situation all by itself creates tougher standards in some cases to get approved for a mortgage. But what happens if a percentage of the millions of homeowners currently in home loan forbearance under the CARES act, FHA emergency measures, or other programs start to re-default on mortgages at a later time?

A mortgage industry publication called National Mortgage News published an article in April of 2020 that includes the following:

"If unemployment climbs to the 15% recently projected by Goldman Sachs, we could be looking at 5.5 million past-due mortgages,”. That could have consequences that include even tighter restrictions on loan approval based on credit issues.

Start Working on Your Credit NOW

If you anticipate the need to apply for any major line of credit, it is in your best interest to start working on your credit as far ahead of time as possible. You should begin by knowing the contents of your credit report; the initial read-through is a good start but NOT the be-all, end-all of the process. It’s vital for many consumers to start monitoring their credit on an active basis.

Identity theft is one major motivation for doing this; another is to ensure inaccurate data doesn’t suddenly appear on your report ahead of your loan application. In normal times the going wisdom includes starting to monitor and work on your credit 12 months in advance. For some consumers, this will NOT be enough time (depending on FICO scores and related issues).

What Not to Do

Don’t fail to plan for your mortgage application in terms of serious issues like job changes, other credit applications, etc. Don’t apply for other credit in the time leading up to your mortgage application for best results. A good rule of thumb? If you have committed to buying a home, also commit to not putting in new credit applications elsewhere.

You should try to avoid a major job change such as switching from salary to commission, salary to contractor, starting your own business, etc. in the year leading up to your application. Conservatively speaking two years is better, but 12 months MAY be sufficient depending on the lender.

This is an observation made in light of the current economic crisis facing many Americans at press time. When things are “normal” job changes and other issues are still something to be aware of, but there is heightened sensitivity to factors that could make your loan a bigger risk for the lender.

------------------------------

RELATED VIDEOS:

A Good Faith Estimate Provides Mortgage Information

Measuring Your Loan-to-Value Ratio

Monitor Your Credit Score

Do you know what's on your credit report?

Learn what your score means.