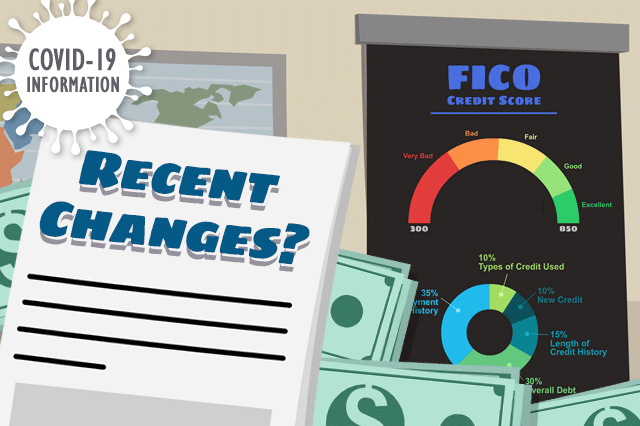

COVID-19 Update: Did FHA Raise FICO Score Requirements for Home Loans?

You may read news stories about higher credit requirements making it tougher to qualify for a mortgage in the era of coronavirus; these stories may be accurate in their reporting of higher FICO score requirements at the time of this writing, but who is responsible for those requirements?

Here’s how it works. The FHA has a set of FICO score ranges that tell the lender whether the applicant is technically qualified to apply for an FHA mortgage, reverse mortgage, refinance loan, construction loan, etc.

FHA FICO Score Minimums

The lowest FICO score technically possible according to the FHA to qualify for a loan (albeit with more expensive terms) is 500.

That is the FHA’s bottom-line lowest FICO score possible. The FHA says borrowers who have FICO scores between 500 and 579 could qualify for an FHA mortgage with a 10% down payment. It’s up to the lender to decide whether a borrower with a 500 credit score is worth the financial risk of extending credit to.

Borrowers with FICO scores at 580 or higher technically qualify for an FHA mortgage with the lowest down payment possible (3.5%). It’s up to the lender to decide what FICO scores in this range are worth extending the most competitive interest rates and other terms to.

The lender uses multiple factors to determine what interest rate to offer you, what down payment option is required, etc. The FHA minimums are just that; minimum requirements that the lender may add higher standards to (not lower ones) at their discretion. The FHA requirement is that rates and terms offered to the borrower are reasonable and customary for that type of loan in that housing market.

Lender FICO Score Requirements

The reports you may read about tougher FICO scores could be true, but the responsible party for those higher requirements is not the FHA; at the time of this writing there are no FHA Mortgagee Letters or alterations to the online version of the FHA Single-Family Handbook that reflect a policy change for FHA mortgages with regard to FICO score minimums.

If it is harder to get a home loan at your FICO score range at the moment, it’s due to the choices your participating lender has made, not the FHA. That could change depending on government policy decisions later down the line, but at press time FHA has not altered its FICO score requirements.

That’s one reason why it’s key to protect your credit scores as much as possible during the economic impact of coronavirus / COVID-19. Your access to credit going forward will depend much more heavily on your FICO scores, loan repayment habits, credit utilization, etc. Don’t go another week without examining your credit report and taking steps to protect your credit. And if you are already looking for a lender, you may need to shop around more aggressively for one to find a financial institution willing to work with you and your circumstances.

------------------------------

RELATED VIDEOS:

Don't Skip the Home Inspection

Bigger is Better With a Jumbo Loan

Insuring Mortgages With the FHA Funding Fee

Do you know what's on your credit report?

Learn what your score means.