Down Payment Rules for Home Loans

Down Payments Are Not Identical

Some borrowers who work on their credit long before applying for a loan may be eligible for the best down payment terms. You may be required to make a larger down payment if your credit score is too low; lender requirements and the home loan program you apply under will have a say in what that higher down payment should be.

The bottom line in this area? Work on your credit aggressively, and as early as possible.

Down Payment Requirements Are Not Identical

Conventional down payments will vary, but unless you want to pay 20% to kill private mortgage insurance, you will trade a lower down payment for the private mortgage insurance premium, which may be payable until you reach 20% equity in the home unless other arrangements are agreed upon.

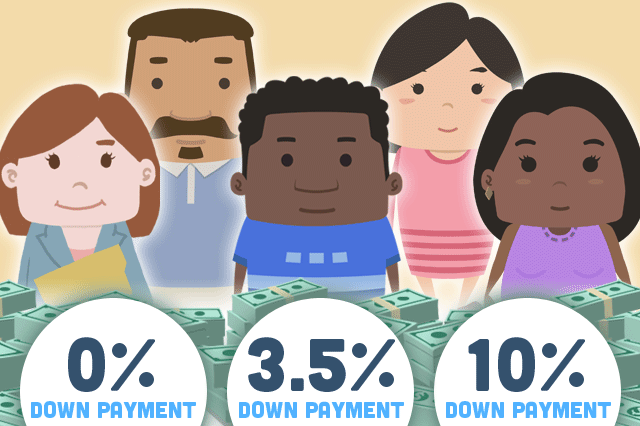

A VA borrower typically makes NO down payment unless they are trying to reduce the amount of the VA loan funding fee, which reduces depending on how much down payment you make.

USDA loans have a similar no-money-down feature, but USDA loans are need-based, and have a household (NOT individual) income cap that will apply no matter how many people are obligated on the loan.

VA loans are for qualifying military members, USDA loans are need-based. FHA mortgages, by comparison, are much more available to typical house hunters with their low 3.5% down payment requirement in typical cases.

FHA Down Payments Have Options

Consider the option to apply for a local down payment assistance or homebuyer’s grant with an FHA mortgage. You can also negotiate with the seller to provide a certain amount of help from the seller for closing costs.

Your down payment expenses may not come 100% out of pocket with help such as this, but the FHA has nothing to do with such negotiations and it will be up to you to locate a down payment assistance plan in your local area.

FHA loans may provide the right borrower with the help a borrower needs to find or build a new home, even the first time out. Talk to a participating lender about your FHA loan options.

------------------------------

RELATED VIDEOS:

A Good Faith Estimate Provides Mortgage Information

Measuring Your Loan-to-Value Ratio

Monitor Your Credit Score

Do you know what's on your credit report?

Learn what your score means.