FHA Home Loan Approval Rules About Debt Ratios

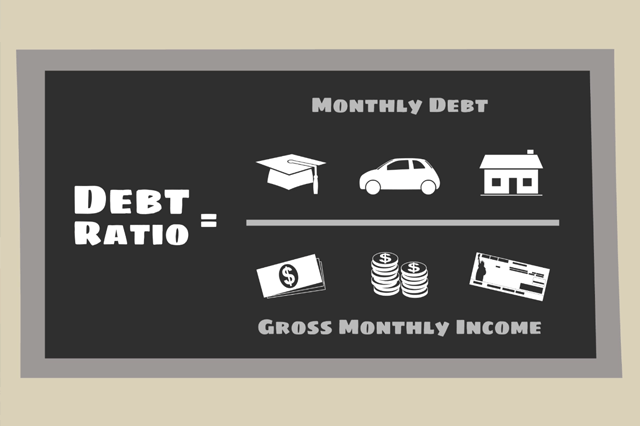

This is known as a debt ratio or a debt-to-income ratio. FHA home loans have requirements that a borrower’s debt ratio fall within certain ranges and that range may vary depending on certain factors including credit scores.

In general, your total monthly debt (including a projected mortgage payment) should not exceed 41% (maximum) of your total monthly income.

But the lender may not consider some things as income such as earnings from selling goods or services on eBay, the housing allowance veterans get for using the Post 9/11 GI Bill, and other income that is not deemed “stable and reliable” and/or likely to continue.

The lender may not consider all your outgoing financial obligations as debt, either. In fact, the FHA single-family home loan handbook, HUD 4000.1, has a list of things not to be considered as debt which include taxes (if not delinquent and no payments have been required), medical collections, retirement contributions, child care expenses, utilities, and other related expenses.

You will need to discuss these areas with a loan officer to see how they may affect loan approval depending on your debt ratio and other factors.

Generally speaking, the lender will use “effective income” to determine your debt-to-income ratio. What does the lender consider to be effective income? FHA loan rules vary depending on the type of income such as hourly, salary, commission, etc. For hourly, HUD 4000.1 states;

“For employees who are paid hourly, and whose hours do not vary, the Mortgagee must consider the Borrower’s current hourly rate to calculate Effective Income.” But in cases where an employee is paid on an hourly basis but those hours vary, the lender is required to average the income earned for the past two years.

For salaried employees, the income used to determine the debt-to-income ratio is based on the current salary assuming that it “has been and will likely continue to be consistently earned” according to HUD 4000.1.

For commission income, getting a figure the lender can use to calculate the debt ratio involves a review of how long the income has been earned and how stable it is. “The Mortgagee may use Commission Income as Effective Income if the Borrower earned the income for at least one year in the same or similar line of work and it is reasonably likely to continue.”

Ask a loan officer if you need more information on how debt ratios can affect your loan application’s chances for approval.

------------------------------

RELATED VIDEOS:

Don't Skip the Home Inspection

Bigger is Better With a Jumbo Loan

Insuring Mortgages With the FHA Funding Fee

Do you know what's on your credit report?

Learn what your score means.