Do You Need to Know Your Credit Score?

In fact, the study says that basic credit score information is sometimes an issue. According to one portion of the report, “Despite increased exposure to credit scores and online information, consumer understanding about what it takes to qualify for a mortgage has not improved since 2015” in spite of improved consumer confidence.

“More consumers report seeing their credit score recently,” the report states, “but close to half still cannot recall what it is.”

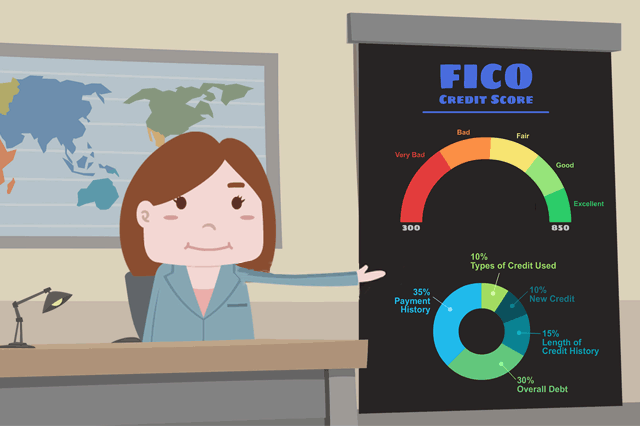

Do you need to know if your credit score qualifies for an FHA mortgage or refinance loan? The first thing you should know is that FHA requirements say that borrowers with FICO scores between 500 and 579 are technically eligible for an FHA mortgage but would be required to put a higher amount of money down. The down payment requirements from the FHA (not the lender) in these cases is 10%.

Borrowers with FICO scores 580 or higher technically qualify for the lowest down payment of 3.5%. But what many don’t understand is that these are FHA loan program minimums and lender requirements may be higher.

And that is why it’s crucial to shop around for an FHA lender who can offer you the most competitive rates and terms.

Knowing your FICO score is important, and the 2018 government report mentioned above says that four in ten consumers don’t know their credit scores. You should never fill out loan paperwork without knowing your FICO scores and what you may need to do to improve those scores when appropriate.

And you do not have to pay a third party to improve your credit. You start improving your credit by establishing a consistent record of on-time payments for all financial obligations and sticking to it. You improve your credit by reducing the balances on your credit cards to well under the halfway-to-maxed-out point.

You can also improve your chances at loan approval by avoiding new credit lines in the months leading up to the loan application.

You are entitled to a free credit report from the three major reporting agencies once per year. You should investigate your credit report for evidence of identity theft, erroneous information, and you should look into your options for learning your FICO scores and improving them.

Start preparing a year in advance of your home loan and you will get a lot closer to loan approval by learning your credit score, finding a lender that can work with your credit scores, and start improving your credit as soon as possible.

------------------------------

RELATED VIDEOS:

Learn How to Meet FHA Requirements

A Few Tips About Your Fixed Rate Mortgage

Your Proof of Ownership Is the Property Title

Do you know what's on your credit report?

Learn what your score means.